Safety Innovations and Discovery of New Niches Set the U.S. IV Therapy Market on the Move

By Andrew Ignatov and Kamran Zamanian, Ph.D., iData Research Inc.

For the last 40 years, intravenous (IV) infusion therapy became as ubiquitous as cots and syringes. In the U.S., for every hospital bed, there are almost 2 electronic IV pumps used. Therefore, over the past few years, this has saturated market. However, this proved to be an arena for steady sales growth for both market leaders and technology innovators. The main challenge facing health care providers and device manufacturers is how to make this therapy safer but also more accessible.

The industry addresses this challenge in two ways. On the one hand, recent market consolidation, conducted primarily though mergers and acquisitions has provided resources for additional R&D activities.1 On the other, new market entrants among medical device manufacturers benefit from expanding use of IV technology for the use outside the hospitals.

Hundreds of U.S. and international manufacturers support this sector with their intravenous infusion pumps (IV pumps), intravenous infusion line sets (IV sets), needleless connectors for IV sets (NLCs), and their consumables: such as filters and stopcocks for IV sets (in-line filters and inline stopcocks). Doctors and medical personnel use methods of IV therapy for infusing medications, saline water for hydration, reagents, and blood in more than a hundred million procedures every year. Doctors prefer, and sometimes require, the use of IV therapy, for addressing dehydration, pains, gastrointestinal conditions, sepsis, osteomyelitis, hemophilia, multiple sclerosis, arthritis, immune deficiencies, and cancers, where IV infusions allow direct and quick access to the blood stream of a patient.

In the U.S., integration of electronic medical records together with medical devices including electronic IV pumps, which allow for the storage, retrieval and modification of medical records, is becoming prevalent. Smart pumps are devices that allow programming doses through individual drug libraries for every patient and determine unit calculations automatically when a drug is selected. Smart pumps lessen the number of potential errors due to improper dosages and allow the automatic updating of electronic medical records because of their connection to a hospital record system. As medical records become more automated, it is expected that infusion pumps will become increasingly automated as well. As electronic medical records and smart pumps increase their penetration into the U.S. market, the infusion pump market value is expected to increase.

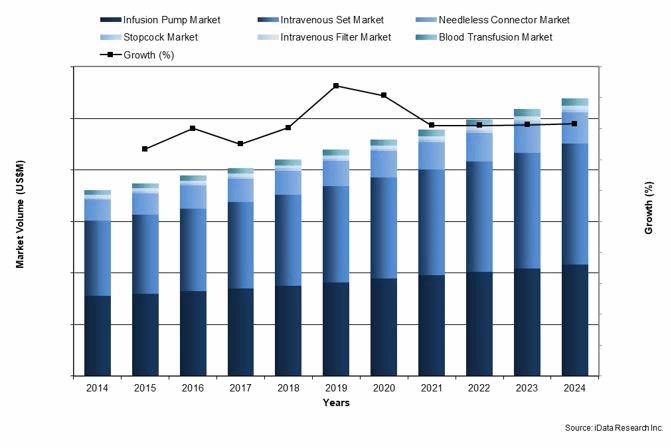

Infusion Therapy Devices Market Growth, U.S., 2014-2024

Safety of IV devices is being monitored and improved on many levels. Equipment manufacturers issue product recalls when problems are identified.2 Health care providers regulate application of drugs via internal policies. Self-regulating organizations, such as Infusion Nurses Society (INS) and the National Home Infusion Association (NHIA) conduct conferences and workshops to enhance IV delivery safety. In the latest INS published Infusion Therapy Standards of Practice 3, and Policies and Procedures for Infusion Nursing4, guidelines are established for institutional policies. As a result, the market expects both replacement and new devices for infusion therapy to be continuously improved and demands higher standards from suppliers. Since 2014, a number of manufacturers started bringing compact IV devices to previously underserved and currently expanding niches, such as home care.5

The alternate and home care segments are becoming an increasingly large portion of the total market at the expense of the acute care market. Prices tend to be higher for devices purchased by alternate care sites because there are no bulk buys or group purchasing organizations involved, as there are for hospitals and larger clinics. The number of patients receiving treatment in alternate care sites, such as in outpatient clinics and nursing homes, declined slightly in 2008 and 2010; however, the number of patients in the alternate care setting is expected to increase more rapidly than the hospitalization rate, as was the trend for the past three decades.

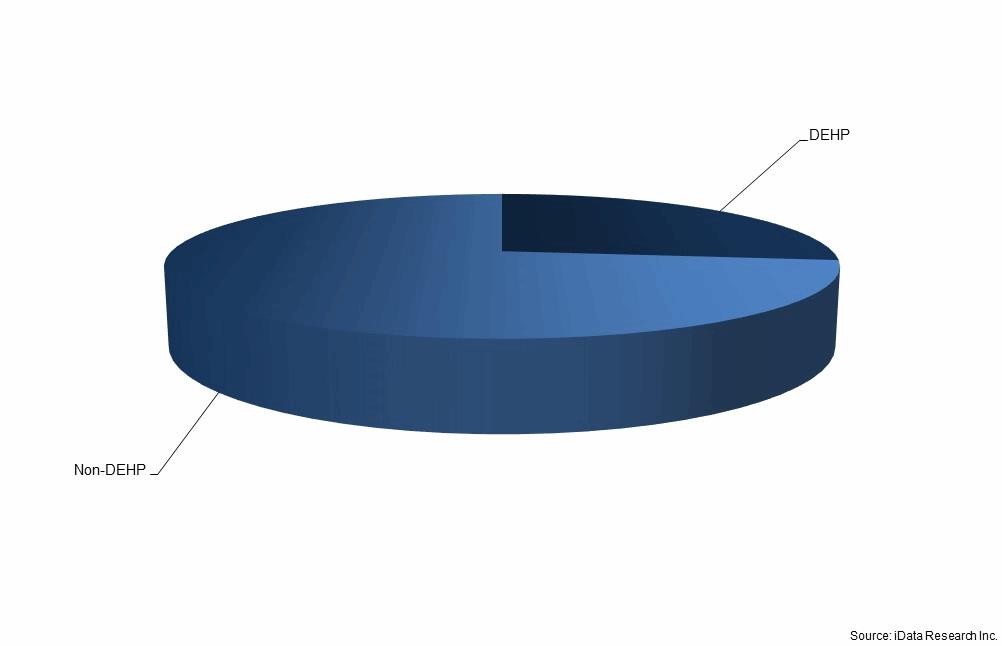

Besides equipment, the industry is currently focusing on improving the design of the disposable elements used in IV therapy, such as IV lines, filers, stopcocks, and the needleless connectors. A benefit from past efforts, all IV lines, which are currently used in the U.S., do not use needles, thus avoiding thousands of sharp object injuries by the medical personnel prevalent in the 1980s and 1990s. A recent study found significant differences between performance levels of needleless connectors leading to different levels of CRBSI risk.6 Such growing availability of clinical evidence regarding the safety and performance of IV therapy medical devices provides opportunities for IV therapy device market players to shine. Another area for future improvement for IV device manufacturers is the availability of IV lines and other plastic units, which do not contain potentially harmful DEHP plasticizing components.

Share of IV sets containing DEHP-based plastics, U.S., 2017

In 2017, Becton Dickinson (BD) led the U.S. infusion therapy device and consumables market. Becton Dickinson entered the market via its acquisition of CareFusion in 2015 and has gradually expanded its market share in IV devices since then. IV sets for BD’s Alaris® product line includes primary, secondary and IV extension sets, all of which are bundled with the sales of their Alaris® large volume syringe and PCA infusion pumps. ICU Medical expanded its market share in IV devices by 16% with its acquisition of Hospira in early 2017. Other leading competitors in the U.S. IV devices market include Baxter International, B. Braun, GVS, Halyard, Pall Corporation, Smiths Medical, RyMed Technologies, and Nexus Medical.

Conclusion

A mature market, U.S. intravenous therapy is an exciting sector for medical device manufacturers. With consumer expectations aligned towards technological innovation and newly discovered niches, such as home care, the market is set to expand, while reshuffling products incorporate both existing suppliers and new entrants.

About the Authors

Andrew M. Ignatov is research analyst at iData Research Inc. His served as lead researcher for the preparation of iData’s 2018 U.S. Intravenous Therapy Devices Market Report.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting group focused on providing market intelligence for medical device and pharmaceutical companies. iData covers research in: diabetes drugs, diabetes devices, pharmaceuticals, anesthesiology, wound management, orthopedics, cardiovascular, ophthalmics, endoscopy, gynecology, urology, and more.

References

1. S. Collins. Inside Becton Dickinson’s Biggest Growth Driver. https://finance.yahoo.com/news/inside-becton-dickinson-biggest-growth-120607073.html; accessed October 15, 2017.

2. For example, Moog Medical Device Group sent an "Urgent Recall Notice" dated December 22, 2015, to all affected customers to recall its Curlin Ambulatory Volumetric Infusion Pump™, whose calibration might have led to a 6.8% overdose of fluids. Most major IV therapy device manufacturers issued product recalls in the past several years. -- U.S. Food and Drug Administration. https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfres/res.cfm?id=142508; accessed October 15, 2017.

3. https://www.ins1.org/Store/ProductDetails.aspx?productId=113266

5. U.S. National Library of Medicine. IV treatment at home. https://medlineplus.gov/ency/patientinstructions/000496.htm; accessed October 15, 2017.

6. Nancy L. Moureau; Julie Flynn. Disinfection of Needleless Connector Hubs: Clinical Evidence Systematic Review. https://www.hindawi.com/journals/nrp/2015/796762; accessed October 15, 2017.

7. U.S. Market Report Suite for Infusion Therapy Devices 2018 – MedSuite, iData Research Inc.