Spectranetics To Pay $230 Million For Angioplasty Company AngioScore

By Jof Enriquez,

Follow me on Twitter @jofenriq

Spectranetics, a manufacturer of medical lasers and minimally invasive devices for cardiovascular procedures, announced that it is acquiring cardiovascular balloon maker AngioScore for $230 million plus contingent regulatory and commercial milestone payments. The merger agreement, expected to be completed by the end of June, will make AngioScore a subsidiary of Spectranetics.

“We have consistently discussed our strict criteria in evaluating partnering opportunities,” Scott Drake, president and CEO of Spectranetics, said in a company press release. “AngioScore meets our criteria with an exceptional strategic fit, leverageable call points, differentiated technology, and clear operating efficiencies. As a combined entity, we expect to have a meaningfully expanded market opportunity and a compelling product portfolio.”

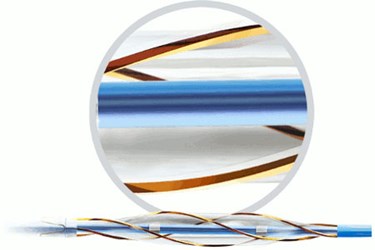

Spectranetics stated that the merger will expand its portfolio of products for coronary and peripheral artery disease patients, including the addition of AngioScore’s AngioSculpt drug-coated scoring balloon catheter for angioplasty procedures. Spectranetics also believes the agreement will help bolster sales and marketing capabilities, improve operating efficiencies and savings, and increase life-saving and limb-saving solutions for patients.

“Simply put, we are ‘better together’,” AngioScore president and CEO Thomas R. Trotter said in the press release. “We believe that this combination provides an opportunity to build a remarkable future while delivering life-impacting technologies to physicians and patients. In Spectranetics, we find a like-minded partner that shares our values, our commitment to improving patients’ lives, and equally high standards for operational excellence and quality.”

According to an article in The Gazette, the California-based AngioScore generated $55 million in revenue and grew 20 percent last year. It would be Colorado-based Spectranetics’ largest acquisition in its 30-year history.

Spectranetics is funding the deal with $115 million in cash and $115 million in common stock. However, the agreement allows Spectranetics the option to finance the entire purchase price with proceeds from a proposed convertible note offering. In fact, according to a separate press release, Spectranetics intends to pursue that option, offering $200 million in an underwritten public offering with a “30-day option to purchase up to an additional $30 million aggregate principal amount of the notes.”

Image credit: AngioScore