The 3 Business Models That Will Attract Buyers To My High-Cost Medical Device

By Eva Marchese and Lorenzo D’Angelo, CRA

The global medical devices market is projected to grow at 4.4% CAGR until 2025.1 But large medical devices with high initial procurement costs are experiencing growing pains. Customers are now scrutinizing prices as transparency of the procurement process increases and hospital consolidation weakens manufacturers’ negotiating positions. Facing these challenges, manufacturers have offered financing options to allow customers to spread the cost over multiple years. Yet, it is becoming harder for device makers to justify price premiums. It is even more challenging to convince customers who already own a large medical device to switch and upgrade if there are no cost saving benefits from doing so.

The Challenge Of Selling Large Innovative Medical Devices

In recent years, buyers are more carefully examining their annual budgets and cost of devices, leaving it largely to manufacturers to help buyers secure sources of funding. Manufacturers of large devices need to ensure that procedures that use a new device are reimbursed adequately and to justify to buyers why the expected use of a device is worth the up-front investment. It is possible for them to defend price premiums, but generally only if a device lowers the other costs incurred by the buyer per patient, per use. More importantly, buyers, including hospitals, are often motivated to acquire a new device if they anticipate a high expected rate of use. The speed at which a device will help its buyer recoup procurement costs and start generating profits will depend on the frequency of use and reimbursement level for associated procedures. A high reimbursement rate will ensure that procedures will help cover the cost of procurement and device maintenance on top of the costs incurred to perform the procedures. As device manufacturers work to address any challenges in selling their large, high-cost products, there are three innovative business models that are emerging to attract buyer interest.

Innovative Business Models

Expansion Into New Indications

One approach manufacturers can take to alleviate buyer budget pressure is to pursue additional indications and multiple purposes for a device. In one example, by redesigning a surgical robot to have additional robotic arms with different precision levels suited for different parts of the body, doctors would be able to use the device in more types of surgeries.2 In another example, cancer radiotherapy devices have expanded to be able to treat multiple types of cancer, such as lung, liver, pancreas, and head and neck cancer, to name a few.3 By adopting a business strategy where a device is positioned to expand into new indications and thus be used more frequently, manufacturers can help make a device more attractive to buyers under budget pressure looking to recoup up-front procurement costs as quickly as possible. Manufacturers of high-cost, often large devices will need to plan life cycle strategies starting early in development to access the full potential of their products.

Alternative Forms Of Financing

Offering alternative financing options for devices, such as leasing, is another widely used method for addressing buyer budget pressure. In one example, Siemens Healthineers developed customized leasing agreements with individual hospitals in the U.S. to offer flexible contract terms based on factors including the length of the contract, monthly installments, depreciation, maintenance, servicing, and upgrade frequency.4 In emerging markets such as China, where most hospitals have limited budgets for purchasing high-cost, potentially million-dollar devices, Siemens cooperated with distributors that specialize in opening diagnostic imaging centers. The company also offers vendor financing solutions to potential distributors.5 Some distributors purchase devices up front, allowing Siemens to collect revenue immediately, and then provide flexible financing options for hospitals while signing agreements for Siemens to continue to deliver value-added services to hospitals through parts and technology services. Some distributors even run imaging centers inside hospitals and assume full responsibility for the profit and loss.6

Compared to one-time payments, equipment financing and leasing options will ensure a longer-term revenue stream for manufacturers. This approach also allows manufacturers to sell to buyers that cannot afford one-time payments, which could help those with innovative devices break into a market that is controlled by more established manufacturers. However, manufacturers should be prepared for challenges with contract administration and to support buyers in justifying contract renewals.

Innovative Pricing

Many manufacturers are also implementing innovative pricing models to lower buyer-side pressure. Some have developed shared savings contracts with hospitals, where they supply devices at a low price in exchange for a percentage of the revenue from using the devices. For example, GE Healthcare entered into an agreement with Temple University Health System (TUHS) to provide radiologic imaging equipment and services over a seven-year period. Under the agreement, GE is responsible for using new technologies to optimize TUHS’s operation processes and is entitled to receive a portion of the shared savings if performance goals are met.7 With this structure, the seller and the buyer are aligned on the objectives to lower costs, improve patient care, and increase the overall quality of service.

Some manufacturers have also offered buyers risk-sharing managed equipment services contracts. With these agreements, hospitals pay an annual fee so that the service provider can handle the full set of device needs, allowing hospitals to shift all equipment procurement concerns to the contracted service provider and the service provider to receive payment based on device performance improvements.

But manufacturers could face challenges in agreeing with buyers on the metrics for innovative pricing and the consequent implications for payment, potentially increasing the costs to serve customers.

Recommendations For Manufacturers

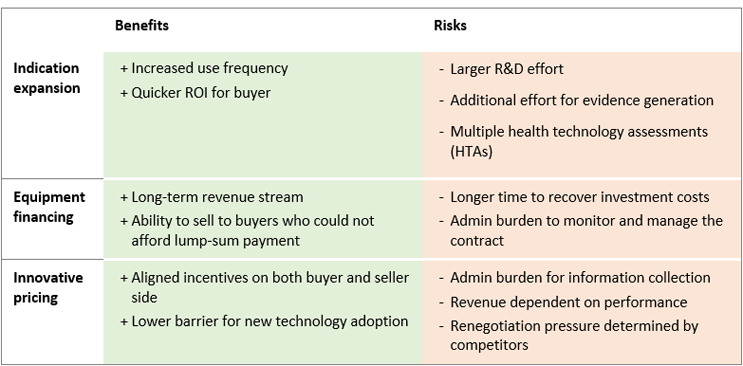

Figure 1: Benefits and Risks of Innovative Business Models

Source: CRA

Each business model presents benefits and risks (see Figure 1) that device manufacturers will need to consider when developing strategies for research and development, commercialization, and market access. Moreover, these models could be combined. In just one example, an existing device could require an added component to be used in a new indication. This new component could be sold combining a monthly fixed fee and an additional fee for use. The ability to combine these approaches adds complexity but can also open access to additional funding budgets. For example, a payment tied to product use is more likely to be financed through the reimbursement a clinic receives, whereas a one-time fee is more likely to be financed through a capital expenditure fund, depending on the specific country and region.

It is essential that manufacturers develop a go-to-market strategy early, including a business model that reflects both the value of a device in the eyes of potential users and buyers considering alternatives on the market and the willingness of purchasing decision-makers to pay for each potential reimbursement pathway and agree to innovative pricing models. These considerations will vary across countries and from hospital to hospital, depending on the procedures performed, in what volume, and in which indications. Manufacturers will need to be able to adapt and offer different business models based on the market and the account or account archetype.

They will also need a comprehensive understanding of the clinical landscape, current purchasing models, and reimbursement pathways, which should be informed by research and discussions with stakeholders including physicians, hospital managers, and local and national payers to understand their needs, expectations, and willingness and ability to pay for high-cost innovative devices.

References

- https://www.medgadget.com/2019/09/medical-devices-market-to-rise-at-5-4-cagr-usd-612-7-bn-2025.html

- https://www.technologyreview.com/2020/02/11/844866/robot-assisted-high-precision-surgery-has-passed-its-first-test-in-humans/

- https://www.varian.com/about-varian/newsroom/press-releases/brain-cancer-patient-receives-first-truebeam-stx-treatment

- https://assets.new.siemens.com/siemens/assets/api/uuid:14b81199e6c8f2f5d9a3c7b9f9bd80c543

160565/version:1510864935/sfs2017-equipmentfinancing-web.pdf - https://new.siemens.com/global/en/products/financing/equipment-and-technology-finance.html#ForvendorsDrivingcustomersaleswithinnovativefinancing

- https://www.massdevice.com/premier-dx-health-signs-china-vendor-agreement-with-siemens/

- https://www.radiologytoday.net/archive/rt0116p14.shtml

About The Authors:

About The Authors:

Eva Marchese (emarchese@crai.com) is a vice president in the Life Sciences Practice of CRA, based in London. She specializes in competitive strategy, pricing, market access, and research in the pharmaceutical, biotech, and life sciences industries. Marchese has an extensive consulting background with a focus on advising pharmaceutical, medical device companies, and medical technology (medtech) companies on global pricing and market access.

Lorenzo D’Angelo (ldangelo@crai.com) is a principal in the Life Sciences Practice of CRA, based in Munich. D’Angelo is an experienced life sciences consultant helping global pharmaceutical, medical device, and medical technology (medtech) companies with their commercial strategy.

Lorenzo D’Angelo (ldangelo@crai.com) is a principal in the Life Sciences Practice of CRA, based in Munich. D’Angelo is an experienced life sciences consultant helping global pharmaceutical, medical device, and medical technology (medtech) companies with their commercial strategy.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.