The Current & Future Outlook For Precision Medicine In Women's Health

By Mané Mikayelyan, DeciBio Consulting

Precision medicine has fundamentally altered science and healthcare over the last few decades, but the majority of advances have been focused on oncology, while other disease areas, such as women’s health, have been overlooked. Women’s health is a relatively broad field that focuses both on conditions unique to women and conditions that disproportionately affect women, such as heart disease and Alzheimer’s. However, the field is increasingly seeing activity in improved diagnostics and therapeutics, as well as an increase in digital health tools improving access to personalized care. The promise of shifting away from a “one size fits all” strategy in women’s health is most clear in advances in breast cancer care, but more recent activity shows precision medicine is possible across many aspects of women’s health outside oncology.

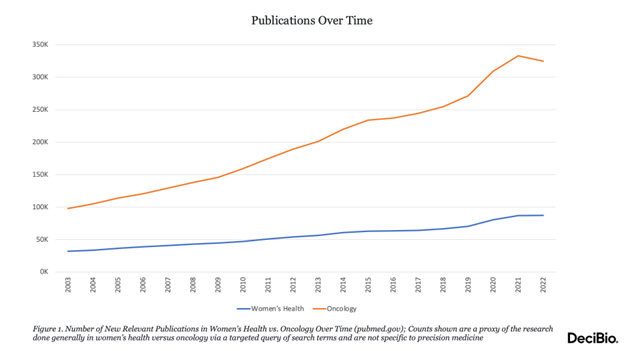

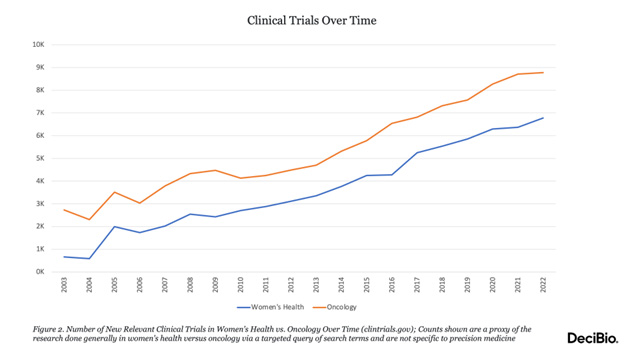

Significantly more research is necessary to uncover a better understanding of women’s unique biology critical to laying the groundwork for true precision medicine in the future. Given gender-specific pharmacodynamics/pharmocokinetic differences and a historic lack of representation in clinical trials, there is an unmet need for safety and efficacy data on treatments for women. Safe, effective treatments could be achieved by gaining a better understanding of these differences, along with targeted recruitment strategies and specific eligibility criteria to ensure equitable participation. Research in women’s health is improving, with publications nearly tripling and clinical trials increasing tenfold over the last 20 years (Figures 1 and 2). While precision medicine in women’s health may be decades behind oncology, this uptick in research is likely to soon lead to innovative transformation.

Figure 1

Figure 2

Outside of oncology, there are limited examples of true precision medicine in women’s health implemented clinically today at a broad scale. Of the few, non-invasive prenatal testing and assisted reproductive technologies are by far the most common. However, there are hundreds of companies playing in this space across many verticals, including startups, large biotech, and pharma (Figure 3). Most new precision medicine activity is concentrated around fertility, endometriosis, and pregnancy complications, but there is activity present to some degree in other areas such as the vaginal microbiome, menopause, perinatal conditions, polycystic ovary syndrome (PCOS), and contraceptives. Two key trends observed across verticals are the emergence of Big Data and artificial intelligence (AI) and the increase in direct-to-consumer (DTC) products and apps enabling access to care. A significant portion of activity in women’s health today is based in the digital health realm, compared to oncology activity in molecular diagnostics and targeted therapeutics.

Figure 3

Perinatal Testing

Non-invasive prenatal testing (NIPT) was a revolutionary transformation allowing for non-invasive screening for genetic abnormalities. An estimated 25%-50% of pregnant women in the U.S. receive NIPT for trisomy 13, 18, and 21. Companies are looking to expand into at-home testing, expanded coverage, carrier screening, and prenatal screening and diagnosis of monogenic and polygenic risk disorders. However, NIPT is more of a risk assessment tool that could influence care decisions, such as delivery at a specialized center, than a true precision medicine diagnostic tied to downstream therapeutic options.

Assisted Reproductive Technologies

As infertility rates and fertility treatment costs continue to rise, there has been significant innovation in the infertility space, particularly around DTC solutions to aid in fertility tracking. In vitro fertilization (IVF) has also seen immense improvements driven by AI, from oocyte and embryo selection to laboratory and specimen management systems. Other technologies, such as endometrial receptivity analysis (ERA) and preimplantation genetic testing (PGT), face more criticism and likely will require further research to determine utility in sub-populations; recent recommendations by ACMG are likely to moderate uptake in the near term. However, pharma will likely continue to invest significantly in fertility treatments, evident by acquisitions by companies like Ferring and Sumitovant, and recent advancements such as Celmatix’s new oral fertility drug program to replace follicle-stimulating hormone injections in IVF.

Endometriosis

There is increasing awareness of the huge market opportunity surrounding endometriosis and the complexity of the disease, including its links to infertility and the immune system. One in 10 women are affected, and the average time to diagnosis is a staggering eight years, with limited non-surgical treatment options. Many startups play in this space to aid in less invasive diagnosis, with most taking an RNA-based approach, while others take a proteomic or exosomic approach. Additionally, some leverage single-cell or unique collection methods, such as tampon-style devices. Treatment advances are more limited; GnRH antagonists Orilissa and Myfembree are two of the few approved options available, but both may come with significant adverse effects. Celmatix recently published the largest genetic study on endometriosis to date, uncovering sub-typing data that could pave the way for treatment by stage of disease. Researchers at Sydney’s Royal Hospital for Women also recently became the first to grow tissue from all known types of endometriosis, enabling them to test responses to different treatments. Additionally, other therapies in research include Obseva’s Linzagolix, dichloroacetate, Chugai’s IL-8 blocker, and FimmCyte’s non-hormonal antibody-based treatment.

Pregnancy Complications

With increased awareness of the alarmingly high maternal mortality rate in the U.S., the field has seen a refocus on addressing pregnancy complications. Thermo Fisher received FDA clearance for its preeclampsia risk assessment assay. Others are focusing on tests to determine the cause of miscarriage, improving ultrasound detection of fetal defects via AI, or tackling issues like preeclampsia and preterm birth via various approaches (e.g., RNA + AI, point-of-care, proteomics, digital biomarkers). Treatment advances are limited to a few companies, such as Comanche Biopharma and MirZyme, likely due to challenges enrolling pregnant women in trials.

Vaginal Microbiome

Improved multiplex molecular diagnostics and DTC products are helping women to gain a better understanding of their vaginal microbiome and eliminate trial-and-error treatment for conditions with otherwise similar symptoms, such as bacterial vaginosis and yeast infections. As the vaginal microbiome has been linked to other conditions, such as endometriosis, infertility, and pregnancy complications, some startups like Freya Biosciences aim to create immunotherapeutic treatments.

Contraceptives

Precision contraceptives are another early but emerging reality, with companies like Adyn and Dama Health trying to tackle the birth control selection process. Pharmacogenomics, paired with hormone testing and clinical history, has the potential to significantly improve women’s experience with contraceptives and mitigate side effects.

Polycystic Ovary Syndrome (PCOS)

PCOS activity is more limited on the diagnostic side, but startups are striving to improve treatment options. Some are taking a medical device approach, such as May Health with an ovarian ablation strategy, while others like Celmatix and HBM Alpha Therapeutics seek to advance antibody therapies.

Menopause

The ~40 approved therapies currently available to treat menopause only target symptoms, and success and side effects vary. Most are hormone-replacement therapies, which could slightly increase the risk of breast and ovarian cancer; however, Astellas’ newly approved fezolinetant is non-hormonal. Additionally, research indicates genetics could affect the severity of symptoms, side effects, treatment efficacy, or increase risk of additional health conditions like Alzheimer’s. Many startups today focus on providing menopausal support via virtual care networks or medical devices to relieve symptoms. However, there is still significant potential to innovate toward more personalized medicine, with companies like Oviva Therapeutics seeking to target the cause of menopause: ovarian aging.

Perinatal Conditions

There is currently relatively limited activity in perinatal conditions such as postpartum depression (PPD) and gestational diabetes mellitus (GDM). Examples include digital tools for GDM care, early detection of GDM, and digital therapeutics for PPD. Further research could unlock new opportunities; Cedars-Sinai uncovered protein signatures in the third trimester that could be related to mood and anxiety disorders.

Outlook

As the oncology market saturates, many companies will turn to search for the next big precision medicine market opportunity. Although women’s health is a relatively young market, precision medicine activity will accelerate due to a combination of factors, such as the growing awareness of unmet needs and increased research and investment. Key barriers, such as a historic lack of biological understanding and funding, the political climate, and unique challenges posed by risks associated with R&D in the pregnant population, may moderate growth in the near term.

Although VC funding has seen an uptick recently, with a record-breaking $1.2B raised for women’s health investments in 2021, the space is still severely underfunded relative to the demand and market opportunity. Most funding has been directed toward digital health or care delivery startups. Seed and Series A funding tend to be more common, but as companies grow, there are fewer large funds and investors committed to women’s health, creating challenges for companies pursuing commercialization, clinical trials, and regulatory pathways. However, more investors are growing increasingly aware and committed.

Additionally, with maternal healthcare deserts and a general shortage of OB/GYNs, improved access to healthcare and provider education is critical to ensure new research and advancements are employed; digital health startups are already helping to address access to care. Ultimately, increased sample and data collection enabled by new technologies like AI or smart tampons, paired with increased attention by biotech and pharma (e.g., Ferring and Organon’s investment strategies) will be exciting to watch for innovations with the potential to significantly impact women’s health.

About The Author:

Mané Mikayelan is a project leader at DeciBio, a precision medicine-focused strategy consulting firm. She provides business insights and strategic vision to companies in the life sciences sector, where her expertise spans multiple verticals in diagnostics, pharma, and biotech, but her core passion is advancing precision medicine innovations in women’s health.

Mané Mikayelan is a project leader at DeciBio, a precision medicine-focused strategy consulting firm. She provides business insights and strategic vision to companies in the life sciences sector, where her expertise spans multiple verticals in diagnostics, pharma, and biotech, but her core passion is advancing precision medicine innovations in women’s health.