The Global Cardiac Rhythm Management Market Through 2028

By Kateryna Hronska and Kamran Zamanian, Ph.D., iData Research Inc.

More than 5.4 million cardiac procedures were performed worldwide in 2022 to manage and monitor heart rhythm.1 Every year, this number increases due to the increasing prevalence of cardiovascular disease, obesity, and diabetes associated with the aging population. This article will discuss the main drivers for growth of these medical devices as well as variable purposes for usage.

Cardiac Rhythm Management Trends & Market Overview

Worldwide growth in cardiac rhythm management (CRM) devices can be attributed to the aging of the population. Cardiovascular diseases are much more prevalent among patients over 55 years of age. Therefore, the aging of the population directly correlates with the increasing incidence rate of cardiovascular disease and the increasing need to address it.

According to the World Health Organization, ischemic heart diseases are the leading causes of death worldwide, representing 32% of all global deaths.2 Consequently, affordable, accurate, and fast diagnostics, as well as treatment options, are essential to reduce mortality rates associated with cardiovascular disease. Therefore, companies have to be prepared to respond to the increasing demand for CRM devices.

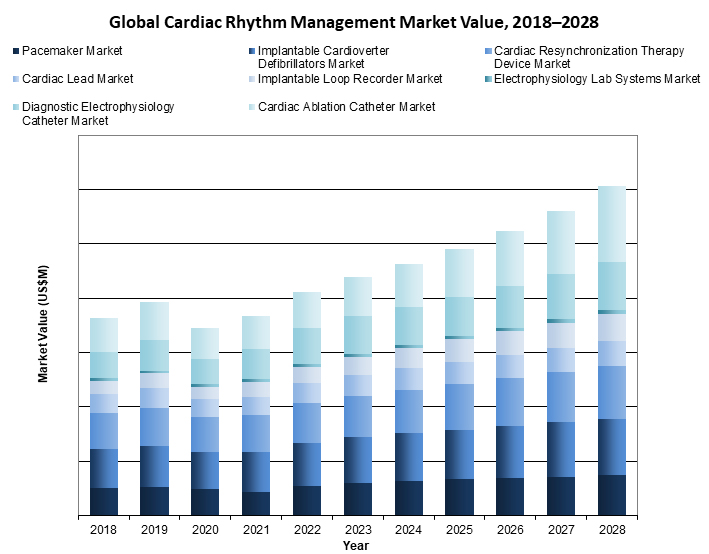

A number of major competitors in the cardiovascular market are benefiting from this market growth, as well as some newer competitors that are bringing novel technology into the market.

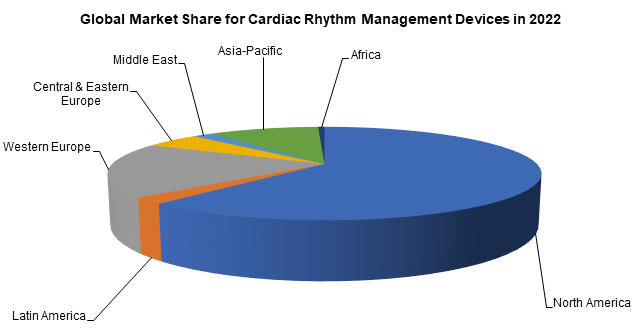

With the high cost of most CRM devices, North America and Western Europe represent the highest percentage of the total market.1 CRM devices are slowly becoming more prevalent across the globe.1

Cardiovascular Disease Diagnostics

As cardiovascular disease remains the leading cause of death in the world, timely, affordable, and accurate detection of abnormal cardiac rhythm is crucial to decrease patient morbidity and mortality. Even though the technology is largely available in high-income countries, it is important to note that lower-income counties experience a shortage of equipment and understaffed and overcrowded hospitals. There is therefore a need for public health policies to improve the quality of life for patients with cardiovascular disease.

There are multiple first resort cardiac tests, which may include blood tests, chest X-rays, stress tests, and an electrocardiogram (ECG). Additionally, there are more complex tests that help to obtain detailed information about a patient’s heart activity.

Lab systems are commonly used devices for cardiac testing. These include 3D mapping systems and electrophysiology (EP) recording systems. These systems combine signals with CT scans to display simultaneous cardiac maps. With their realistic view of the heart, the physician can help locate and define a heart problem. To perform the procedure, the hospital is required to have a specialized lab, which is very expensive. Moreover, the number of labs available in some countries is very limited, making it inaccessible for people living in rural areas or lower-income countries. Therefore, this market is growing slowly and facing pressure to decrease prices.1 Many countries do not have any lab systems, including, for example, Venezuela, Qatar, Cambodia, Nigeria, and others.1

Implantable loop recorders (ILRs) are one type of testing available for patients experiencing irregular heart-related symptoms. Due to the irregularity of symptoms, the doctor may want to implant an ILR, which can monitor the heart rate for up to three years to help narrow the scope of the diagnostic process. ILR is one of the fastest-growing markets in CRM, with more than a 10% procedure growth annually.1 As of 2022, the ILR market is well-established in North America and Western Europe.1 At the same time, other regions of the world are in the process of adopting the technology and are expected to experience low two-digit growth in unit sales in the near future.1 The downside of the device is its high price and the risks associated with the procedure, such as infection, bleeding, and damage to the heart and/or blood vessel.

Diagnostic cardiac electrophysiology is another fast-growing market for cardiac diagnostics. During the procedure, catheters are inserted into a heart area to observe electrical activity. Since the doctor may choose to observe different parts of the heart, there are a number of catheters on the market. Conventional catheters represent the largest portion of the market, followed by intracardiac echocardiography (ICE) catheters. The use of ICE catheters is set to grow rapidly.1 ICE catheters have gained CE and FDA approval for reprocessing, applying downward pricing pressure on the catheter market. This might be beneficial, as ICE catheters are currently quite expensive, which has led to resistance to widespread adoption.

Cardiac Management Devices

As the incidence of cardiovascular diseases grows, so does the need to manage people with cardiac rhythm problems. As of 2021, these are the four most popular implantation methods used to manage irregular cardiac rhythm: pacemakers, implantable cardioverter defibrillators, cardiac resynchronization therapy, and cardiac ablation procedures.

Generally, the implantation of these devices does not disturb a person’s life activities. For a while, people living with pacemakers and implantable cardioverter defibrillators had to avoid MRI machines to avoid disturbing programming of the device. Many manufacturers have recently begun offering MRI-safe pacemakers. These MRI-compatible pacemakers are more expensive than their non-MRI-compatible counterparts, which is extremely beneficial for the overall market as more patients opt for an MRI-safe pacemaker. Medtronic was the first to market in the U.S. with its FDA-approved MRI-safe pacemaker, Revo MRI SureScan.

Pacemakers are the most popular cardiac management devices on the market, with more than 1.5 million procedures performed in 2022.1 The device is commonly implanted into patients with bradycardia, and it regulates the heart rhythm by sending electrical impulses.3 There are four types of devices available on the market right now: single-chamber, dual-chamber, triple-chamber, and leadless. The fastest-growing market in terms of unit sales is the leadless pacemaker market. However, on an absolute value basis, the dual-chamber pacemaker market will see the most growth.1 Although the leadless pacemaker is a relatively new technology, preliminary reports regarding its long-term performance and complications are promising, including low complications, few system revisions, and stable pacing parameters.

Implantable cardioverter defibrillators (ICDs) are implanted for patients at risk of sudden cardiac arrest. Clinical trials have shown that ICDs significantly improve the probability of patient survival compared to prescribed anti-arrhythmic drugs, such as amiodarone. Similar to pacemakers, there are four types of ICD devices on the market: single-chamber, dual-chamber, triple-chamber, and subcutaneous. The fastest-growing market in terms of unit sales and market value is expected to be the S-ICD market, even outpacing the leading dual-chamber ICD market.1 Boston Scientific’s EMBLEM S-ICD was the world’s first S-ICD that provided protection for patients at risk for sudden cardiac death while avoiding the risks and complications associated with transvenous leads. One of the main market limiters is high prices for implantation, which vary from $30,000 to $40,000.

Cardiac resynchronization therapy (CRT) devices improve the pumping action of the heart, especially in patients with left ventricular dysfunction and electrical desynchrony between the right and left ventricles. The device market consists of cardiac resynchronization therapy-pacemakers (CRT-P) and cardiac resynchronization therapy-defibrillators (CRT-D). CRT-D devices are very popular, partly because they have the capability to deal with most types of arrhythmias and can act as a defibrillator in case of a sudden cardiac event. Medtronic is the leader in the market with its CLARIA MRI-compatible CRT-D devices, as well as AMPLIA, and COMPIA MRI CRT-D devices with SureScan technology.1

Conclusion

The global CRM market has been evolving and growing dramatically in the past, and it is expected to maintain growth as the needs of the population increase. ICD and CRT are the largest markets and are expected to overtake pacemakers in the near future.1 Medtronic remains the leading company in the market worldwide.

References

- iData Research Inc. Global Cardiac Rhythm Management Device Market – 2022. Published December 2022. https://idataresearch.com/product/cardiac-rhythm-management-market. Accessed December 2022.

- World Health Organization. (n.d.). The top 10 causes of death. World Health Organization. Retrieved July 19, 2022, from https://www.who.int/news-room/fact-sheets/detail/the-top-10-causes-of-death

- Cardiac Rhythm Management Devices. Australian Journal of General Practice. (n.d.). Retrieved July 19, 2022, from https://www1.racgp.org.au/ajgp/2018/may/cardiac-rhythm-management-devices/

About the Authors:

About the Authors:

Kateryna Hronska is a research analyst at iData Research. She works on research projects regarding the medical device industry, publishing the Global Cardiac Rhythm Management Devices, Electrophysiology & Cardiac Ablation research report.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.