The Hard Truth: Evidence — Not Marketing — Builds A Medtech Business

By Michelle Edwards, Navigant Life Sciences

It’s time for medical technology companies to face the hard reality of the United States market. As the largest medtech arena in the world, the U.S. served for decades as the land of opportunity for innovation, where investors chased “billion-dollar” markets with sincere expectations of achieving them. But, with healthcare spending growing to all-time highs, years of slowing growth rates, and an increasingly crowded, risk-averse marketplace, the U.S. medtech market has shifted from a “let’s try it” frontier to a “prove it” mentality. And we must all embrace it.

In today’s high-stakes trade-off game, only hard evidence – not marketing – propels adoption. That means, to be widely adopted, an advance must conclusively improve or extend human life while being cost-justified over the existing standard of care.

Scientific Data Sways Saturated Medical Markets

Times have changed significantly for medical manufacturers. In the mid- to late 20th century, a crescendo of innovations hit the market, exponentially increasing the medical industry’s ability to care for the spectrum of human need. And clinicians eagerly accepted them – organically driving market adoption for first-time technologies.

These days, an abundance of tried-and-true therapies exist, thanks to advances that eliminated the most basic medical issues and improved life for the majority of humankind. Thus, the margin for improving clinical outcomes is getting ever thinner, and clinicians are reluctant to try something new just for the sake of its promise. This means medtech companies can no longer rely on mere novelty to compel adoption.

Still, many manufacturers elect to get their advanced technologies to early adopters and hope their individual successes will spur marketwide adoption. Others try to use aggressive marketing programs touting the technology’s features and benefits to move the market, sometimes targeting patients themselves in hopes patient demand will sway the informed decision-making of clinical experts.

These methods rarely work, even when companies have seasoned leadership and adequate funding to support their development and marketing strategy.

Even when these methods work, they rarely generate a significant return on investment. Consider, for example, when Medtronic reportedly sank $100 milllion into a direct-to-consumer “sudden cardiac arrest” awareness campaign in hopes of jumpstarting slumping sales for its implantable cardiac defibrillator treatment. Or, think about how many seemingly promising technologies for treating benign prostatic hyperplasia (BPH) never really took off. These BPH technologies presented less invasive options, with presumably faster recovery than the current standard of care (transurethral resection of the prostate surgery), but they lacked evidence of a clear benefit and costed substantially more, rendering clinicians unimpressed and unmoved.

Failures like these are largely the result of economics, as well as the sheer breadth and depth of available successful technology options.

Risk-Averse Physicians Demand More Info, Support

With emphasis shifted from adopting new technologies to fully understanding — and capturing — the benefits of both existing and new technologies, medtech companies must provide comprehensive and conclusive clinical evidence to demonstrate value, as well as help clinicians understand how to match therapies to patients. In other words, rigorous research, clinical trials, and market analyses are must-dos — not “nice-to-dos” — to drive preference across the adoption spectrum and realize full market potential.

Once a manufacturer meets all design and development needs, including sufficient clinical trials to meet regulatory approvals, it might be understandably reluctant to spend even more time and money to conduct further clinical trials and create a compelling validation of the technology’s value. But that manufacturer would be remiss not to — as only those technologies proven to deliver a significant measurable benefit (in terms of improving patient outcomes or reducing provider costs) can hope to see broad long-term adoption. Manufacturers must anticipate, and fundraise for, the extra financial strain of conducting additional research to bring a medical technology from concept to full commercialization.

Healthcare providers simply cannot afford — monetarily or reputationally — to take major risks in terms of investment, time, resources, or patient outcomes. The cost of failure is too high. Procedures and treatments must be proven to justify the time, expense, and risks involved for all stakeholders — providers, payers, and patients.

As a result, many large manufacturers already are reporting economic metrics along with clinical trial outcomes as a matter of course. In addition, such leading manufacturers as Baxter, Boston Scientific, and Medtronic have shifted their marketing programs from simply promoting a technology to promoting that technology’s proven clinical value — communicating information on optimal patient selection and clearly defining where and how the new technology best fits in the marketplace. To compete, other manufacturers must keep pace with these changes.

To Realize Full Market Potential, Become The Standard Of Care

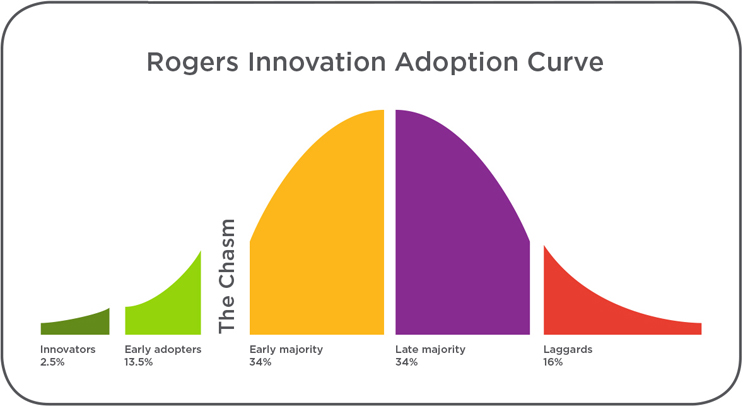

The challenge to achieve deep market adoption remains even after a significant clinical benefit is proven, cost justified, and promoted. The defining constraint to achieving widescale adoption is driving behavior change in those care providers least likely to change (i.e., the conservative and change-resistant attitudes that make up the latter half of the Rogers Innovation Adoption Curve). These providers, unlike innovators and early adopters, are less likely to change behavior to adopt a new technology; this is not new. What is new is that healthcare economics now dictate that persuading providers to accept a new technology means also persuading them to abandon the prior, familiar technology.

Today, a technology can only gain full market adoption by becoming the new standard of care. Consider that robotic surgery proponents explored a variety of applications, for years, until evidence showed definitively that robotic surgery improved radical prostatectomy results. Similarly, the minimally invasive transcatheter aortic valve replacement (TAVR) procedure has become the standard of care for high-risk, inoperable patients with severe aortic stenosis, based on extensive, repeatable, and compelling evidence.

The next wave of major advances in the medical industry — including more robotics, augmented reality, and real-time diagnostics — promises to improve the precision and consistency of procedures and treatments. But, even as these imagination-capturing advances hit the market, they too will face an unforgiving market conditioned to demand unequivocal proof — and reluctant to expose itself to failure.

Moving forward, only those medtech companies that make the investment to objectively cost-justify their new technologies will earn bonafide commercial success. And the only way to do that is with data-driven clinical analysis and objective economic validation that clearly outlines the real return on investment for your healthcare provider customers.

About The Author

Michelle Edwards is an Associate Director in the Life Sciences practice at Navigant. She has nearly 20 years of experience in life sciences, with roles in asset valuation, business development, finance, investor relations and marketing. Her work at Navigant is focused on market development strategy and tactical, local, market development planning. Most recently she has worked on projects in therapeutic areas including ophthalmology, hematology, oncology, orthopedic, peripheral vascular intervention and emergency medicine.