The U.S. Market For Extended Dwell Catheters

By Hadi Salempoor and Kamran Zamanian, Ph.D., iData Research Inc.

An extended dwell catheter (EDC) is a type of intravenous (IV) catheter that is designed for longer-term use than a standard peripheral intravenous catheter (PIVC) but for a shorter duration than a peripherally inserted central catheter (PICC). Like other types of IV catheters, EDCs can be used to administer fluids, medications, and nutrition directly into the bloodstream.

The EDC market in the U.S. currently holds a value of around $55 million, and it is projected to reach close to $100 million by the end of the forecast period (2029), indicating an impressive growth rate of approximately 80%.

Extended dwell catheters provide a solution that fills the gap between PIVCs and midlines. Like midlines and PICCs, most EDCs are inserted in the upper arm, but some shorter catheter models can be inserted in the lower arm, similar to a PIVC. Extended dwell catheters tend to be between PIVCs and midlines in terms of length, ranging from 3 cm to 8 cm at most, but have dwell times comparable to that of midlines; most products in this space are rated for a dwell time of up to 29 days, but actual dwell time is typically shorter.

EDCs offer many of the same benefits as shorter midlines, such as the extended dwell times and the lack of trimming required prior to insertion. They are also almost exclusively power-injectable. However, they tend to be even shorter, with lengths of 6 cm or less being most common, with some models offered at 8 cm to accommodate deep-vein access. Therefore, they are often seen as a reasonable intermediate between using a PIVC and a midline. EDCs are becoming an increasingly popular option for patients who require longer-term IV therapy, particularly those who have difficult veins or require frequent needle insertion. As a result, the market for EDCs has grown in recent years and is expected to continue to grow as healthcare providers seek more efficient and cost-effective alternatives to more invasive IV therapies, such as PICCs. Factors driving this growth include the increasing prevalence of chronic diseases, rising demand for home healthcare services, and advancements in technology that have led to the development of more advanced and safer catheter materials and designs.

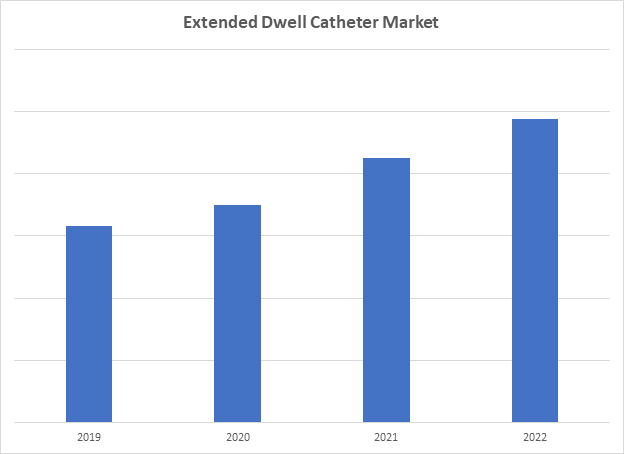

Figure 1: This graph shows a sharp uptick in market growth in 2020–2021, with 2022–2029 indicating growth at a slower rate. Access iData’s U.S. Vascular Access Device and Accessories market report to view more granular data.

COVID-19’s Impact On The EDC Landscape

Providing prompt, secure, and durable vascular access to critically ill COVID-19 patients can be challenging while simultaneously mitigating the potential for viral transmission to healthcare workers and equipment in the surrounding environment.

Recent publications have demonstrated that the procedures for accessing central veins vary between COVID-19 patients and non-COVID-19 patients.1 Unusual vascular access is also common among critically ill patients with COVID-19.2

Studies have shown that, compared to standard PIVCs, EDCs can reduce catheter-related complications.3,4 EDCs tend to reduce needlestick injuries, due to their improved rate of first-stick success, as well as the extended dwell time making subsequent insertions less likely. When accounting for the reduced cost of complications, as well as the need for fewer catheters per hospitalization, EDCs have been shown to reduce total cost to the hospital over PIVCs in some instances. The lower ASP than that of midline catheters also makes EDCs an attractive alternative to that market. Due to these various factors, the U.S. EDC market experienced massive growth during the COVID-19 pandemic, with 11% and 20% market value growth rates in 2020 and 2021, respectively.

Figure 2: Access iData’s U.S. Vascular Access Device and Accessories market report to view more granular data.

Fewer Complications, Lower Price

Studies have shown that, compared to traditional PIVCs, EDCs have reduced the need for additional catheter insertions and increased the rate of first stick success. These two factors result in an overall lower rate of catheter-related complications and needlestick injuries, both of which can be costly to treat at the hospital. For these reasons, some healthcare providers feel that the increased cost of EDCs compared to PIVCs is justifiable in some cases. This is expected to cause EDCs to take some of the PIVC market.

EDCs are similar to both PICCs and midlines in terms of dwell time, insertion, and intended use. EDCs are typically priced lower than both PICCs and midlines and, as a result, the market is expected to erode both of the other markets to some extent. Use of EDCs in cases when midlines or PICCs would typically be used is expected to have a positive impact on the overall market value.

Expanding Competitive Landscape

The U.S. market for EDC catheters grew in 2022 and a steady growth in the future is anticipated. The lower ASP than that of midline catheters also makes EDCs an attractive alternative to that market. Over the forecast period, growth will be driven mainly by a rapid increase in unit sales, together with a moderate increase in ASPs. Unit growth is mostly being driven by EDCs being seen as a viable alternative to PIVCs, which require a longer dwell time, and to PICCs, where a peripheral line is desired over a central line, due to concerns about catheter-related infections.

Some of the main products in this space include Becton Dickinson’s AccuCath series, Teleflex’s Arrow Endurance and Access Scientific’s POWERWAND.

Closing Thoughts

Compared to standard PIVCs, EDCs can reduce catheter-related complications. EDCs tend to reduce needlestick injuries, due to their improved rate of first-stick success, as well as the extended dwell time making subsequent insertions less likely. When accounting for the reduced cost of complications, as well as the need for fewer catheters per hospitalization, EDCs have been shown to reduce total cost to the hospital over PIVCs in some instances. The lower ASP, compared to midline catheters, also makes EDCs an attractive alternative. EDCs can afford to slightly increase in price and still be a lower-cost alternative to midlines. However, although ASP growth is anticipated, it will likely decelerate over the forecast period, owing largely to competitive pressures. Since all major competitors in this space also offer midline products, they will likely want to maintain a price difference between the two markets. Due to the fact that this market is still emerging, it may be possible for new competitors to enter with lower-cost products that are closer to PIVCs than to midlines in price, which could apply downward pressure on the overall ASP.5

References

- Gidaro, A., Vailati, D., Gemma, M., Lugli, F., Casella, F., Cogliati, C., ... & Giustivi, D. (2022). Retrospective survey from vascular access team Lombardy net in COVID-19 era. The journal of vascular access, 23(4), 532-537.

- Chun, T. T., Judelson, D. R., Rigberg, D., Lawrence, P. F., Cuff, R., Shalhub, S., ... & Woo, K. (2020). Managing central venous access during a health care crisis. Journal of vascular surgery, 72(4), 1184-1195.

- Infusion Nurses Society. Infusion Nursing Standards of Practice. Journal of Infusion Nursing. 2021;44(1S):S1-S224. doi: 10.1097/nan.0000000000000395.

- Alexandrou E, et al. Use of short peripheral intravenous catheters: Characteristics, management, and outcomes worldwide. Journal of Hospital Medicine. 2018;13(5):E1-E7.

- iData Research Inc. U.S Vascular Access Device and Accessories Market – 2023. Published March 7, 2023. https://idataresearch.com/product/vascular-access-devices-market-united-states/.

About the Authors:

About the Authors:

Hadi Salempoor is a research analyst at iData Research. He works on research projects regarding the medical device industry, publishing the U.S. Vascular Access Device and Accessories Market research report.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.