Top Growth Drivers & Trends In The Global Spirometer Market

By Raj Shah, CEO, Coherent Market Insights Pvt. Ltd.

Spirometry is a medical test used to measure lung function. It helps to diagnose and follow patients with lung disorders such as asthma, chronic obstructive pulmonary disease (COPD), and other conditions that affect breathing. Spirometry can be performed at a routine office visit. Interpretation of spirometry tests is difficult and depends on the patient's cooperation and the physician's knowledge of the reference values. The best method of interpretation is a step-wise approach, which identifies the severity of a ventilatory pattern and the cause of the pattern.

A spirometry test is a simple way to assess lung function. It measures a person’s forced vital capacity (FEV1) and forced expiratory volume (FEV2), which are crucial measurements of lung function. Low FEV1 may indicate a lung disease, such as asthma or COPD. If a patient’s FEV1 is low, their doctor may prescribe medication or another form of treatment to improve lung function.

The results of a spirometry test are important for healthcare providers, as they help diagnose a condition. Spirometry results may help doctors rule out other lung conditions. Spirometry can also be used to monitor the effectiveness of asthma and COPD treatment, which is often necessary to ensure patients are getting the most out of their treatment.

The emergence of COVID-19 has led to high prevalence of various respiratory diseases. Treatment for acute exacerbations of CPPD events increased during the first six weeks of the COVID-19 pandemic in the U.K. compared with 2019, according to a study published in ERJ Open Research in January 2021.

The global spirometer market is estimated to be valued at $958.0 million in 2021 and is expected to exhibit a CAGR of 9.5% over the forecast period (2021–2028).

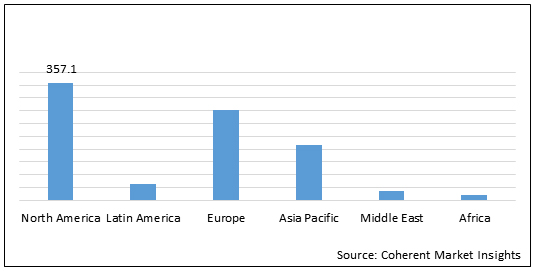

The North American region held the dominant position in the global spirometer market in 2020, accounting for a 37.3% share in terms of volume, followed by Europe and Asia Pacific. This is due to growing patient populations suffering from cardiac diseases and increasing novel product launches by key players operating in the European and Asia Pacific regions.

Figure 1. Global Spirometer Market Value (U.S.$ Mn), by Region, 2020

Access Coherent Market Insight’s Global Spirometer Market Report to view more insights.

Global Spirometer Market Growth Drivers

High prevalence of chronic pulmonary diseases is expected to propel growth of the global spirometer market. For instance, according to the summary in the Cystic Fibrosis Foundation’s Patient Registry for 2003 to 2018, the number of people with cystic fibrosis increased from 21,421 in 2003 to 30,775 in 2018. Cystic fibrosis is an inherited disorder that causes severe damage to the lungs, digestive system, and other organs in the body. Spirometers provide an excellent source to help catch cystic fibrosis infections early on.

The global spirometer market is witnessing the launch of portable devices for the treatment and management of various respiratory diseases. In India alone, crude estimates suggest there are 30 million chronic obstructive pulmonary disease patients. From 1990 to 2016, the crude prevalence of COPD has increased by 29%. Currently, COPD remains the second most common cause of death in India after heart diseases. In November 2021, Cipla launched Spirofy, a wireless, portable device capable of performing lung function tests outdoors and in remote areas, in India to aid in diagnosing people with chronic obstructive pulmonary disease and asthma.

Spirometry Test Failures Highlight Health Inequities

Several studies have reported that certain participant factors may increase the likelihood of spirometry test failure. In October 2021, researchers from the National Institutes of Health Clinical Center reported that spirometry test failure was associated with some definable participant characteristics. The study was carried out in home visits across multiple states in the U.S. The study predicted spirometry test failure, if any, and found that participants who self-reported as Black, male, and making less than $50,000 per year were more likely to fail testing.

Global Spirometer Market Growth Trends

Development & Launch Of Connected Devices For Pulmonary Rehabilitation

Various startups are focused on offering pulmonary rehabilitation services and monitoring through connected devices, such as nebulizers, spirometers, and pulse oximeters. These startups are focused on raising funding to boost their expansion in the global spirometer market. For instance, in November 2021, Wellinks, a digital healthcare company, raised $25 million to expand access to its integrated virtual management system for chronic obstructive pulmonary disease. Similarly, in July 2021, NuvoAir raised $12 million in Series A funding to expand a digital care platform for people in the U.S. and Europe for the treatment and management of respiratory disorders.

Development & Launch Of Cough Monitoring Apps

The global spirometer market is witnessing the launch of cough monitoring apps for the treatment and management of various respiratory diseases. For instance, in May 2021, NuvoAir launched NuvoAir Cough, a new mobile app for home use that can record and analyze coughing sounds made by patients with lung conditions, such as chronic obstructive pulmonary disease. It includes Air Next, a Bluetooth spirometer, measuring several lung functions.

Development & Launch Of At-Home Spirometry

At-home spirometry may help with lung function monitoring in patients with idiopathic pulmonary fibrosis who have preserved lung function. In a study titled Home spirometry in patients with idiopathic pulmonary fibrosis: data from the INMARK trial, published in the European Respiratory Journal in January 2021, an international team of researchers reported that home spirometry was a feasible and valid measure of lung function in patients with idiopathic pulmonary fibrosis and it preserved forced vital capacity.

Key Takeaways Of The Market:

- Among application segments, the chronic obstructive pulmonary sub-segment held the dominant position in the market and accounted for a 22.3% share of the global spirometer market in 2020. The segment is expected to reach $441.6 million in 2028, due to the growing prevalence of COPD. For instance, according to an article published in the European Respiratory Journal in 2019, the worldwide mean prevalence of COPD was estimated to be around 13.1% in 2019, as compared to 11.7% in 2010.

- Among product type segments, the hand-held sub-segment held the dominant position in the market and accounted for a 40.1% share of the global spirometer market in 2020, due to unique advantages offered by the hand-held spirometer over other types of spirometers.

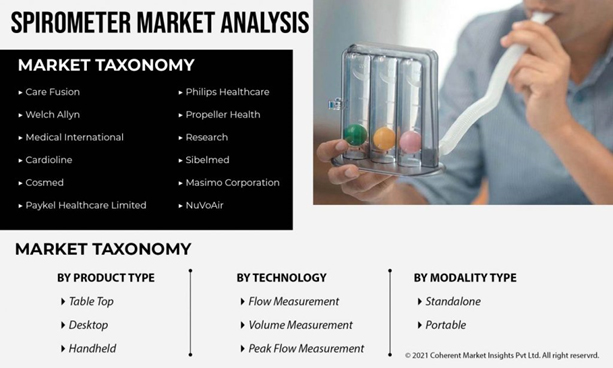

Major players operating in the global spirometer market include Sun Pharmaceutical Industries Ltd., GlaxoSmithKline plc., Nestlé S.A., Fresenius Kabi AG, BASF, Zeon Lifesciences Ltd., Danone S.A., Mead Johnson & Company, LLC., B. Braun Melsungen AG., Baxter International Inc., Nutrimed Healthcare Pvt. Ltd, Abbott Laboratories, and Zenova Bio Nutrition.

Summary

The high prevalence of chronic pulmonary diseases and increasing R&D of portable devices are major factors that are propelling the growth of the global spirometer market. However, several studies have reported that certain participant factors may increase the likelihood of spirometry test failure. This in turn is expected to limit the growth of the market. The market is witnessing the launch of connected devices for pulmonary rehabilitation and cough monitoring apps, which could drive further growth of the market. The emergence of COVID-19 is expected to boost demand for at-home spirometry, as the pandemic has led to a high prevalence of various respiratory diseases.

More related reports can be found here.

About The Author:

Raj Shah is founder and CEO of Coherent Market Insights, a management consulting and market intelligence company headquartered in India. He is a seasoned strategy professional and business accelerator with global experience, from strategy to on-the- ground operational improvements. Over the last five years, he has extended his horizon from consumer electronics, telecom, and fintech to track various verticals of the healthcare industry.

Raj Shah is founder and CEO of Coherent Market Insights, a management consulting and market intelligence company headquartered in India. He is a seasoned strategy professional and business accelerator with global experience, from strategy to on-the- ground operational improvements. Over the last five years, he has extended his horizon from consumer electronics, telecom, and fintech to track various verticals of the healthcare industry.