Traditional, MIS European Spine Devices Experiencing Continual Growth

By Ash Milton, Jeffrey Wong, and Kamran Zamanian, Ph.D., iData Research Inc.

By Ash Milton, Jeffrey Wong, and Kamran Zamanian, Ph.D., iData Research Inc.

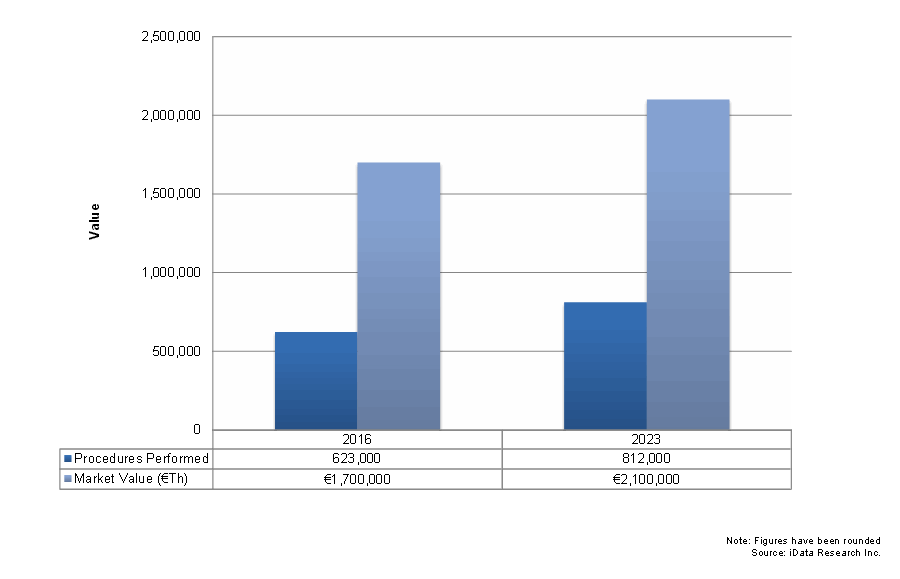

In 2016, traditional spinal fusion device markets continued to experience regular growth. This trend is applied across fixation devices, interbody devices, vertebral compression fracture (VCF) treatment, and other product segments. The major driver across these segments was the European demographic shift toward a growing elderly population. These segments are often well established for reimbursement, which incentivizes development and sales of these devices. The major competitive limiters are expected to be minimally invasive devices and motion preservation. However, traditional devices currently enjoy a strong advantage over the latter in reimbursement and clinical research.

fixation devices, interbody devices, vertebral compression fracture (VCF) treatment, and other product segments. The major driver across these segments was the European demographic shift toward a growing elderly population. These segments are often well established for reimbursement, which incentivizes development and sales of these devices. The major competitive limiters are expected to be minimally invasive devices and motion preservation. However, traditional devices currently enjoy a strong advantage over the latter in reimbursement and clinical research.

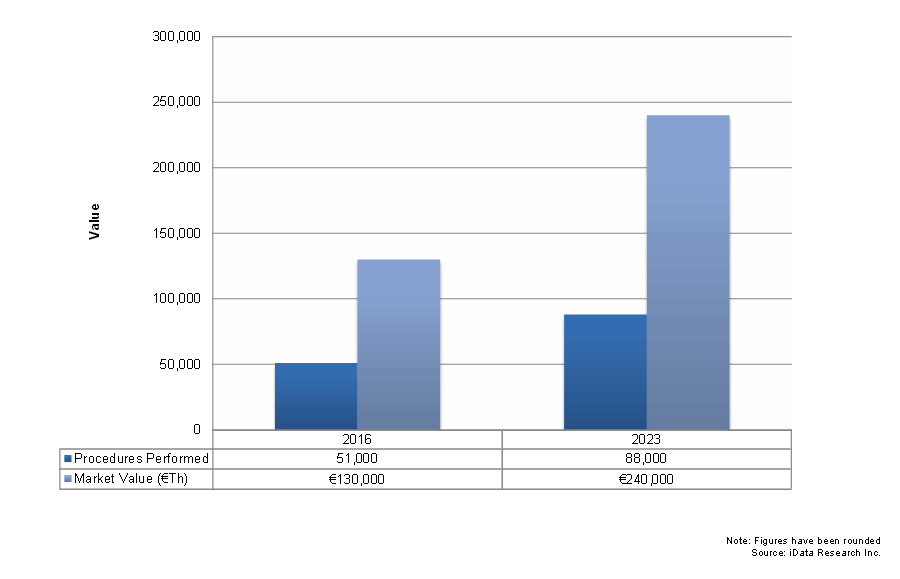

The market for minimally invasive spine devices continued to experience strong growth in 2016. Like with traditional devices, demographic drivers are important for these markets. However, there exist several unique drivers as well. The vast majority of patients show a preference for minimally invasive options when presented with the choice. Despite the greater complexity of these procedures, many younger physicians will be increasingly familiar with these options. Growth in the minimally invasive surgery (MIS) segments is expected to remain strong overall, with a compound annual growth rate significantly higher than the traditional markets.

Traditional Spinal Fusion Growth Driven by Demographics

One of the major drivers of the traditional spinal fusion device industry is age demographics. Two of the major causes of such procedures are osteoporosis and vertebral compression fractures. These complications mainly affect the elderly population. Across Europe, the percentage of patients over 50 consists of approximately 34 percent of the total population, a figure expected to continue increasing over the next several decades. Growth of this particular population segment will have a positive effect on the rise of both fusion and nonfusion spinal procedures.

The VCF market saw the strongest growth among traditional device segments. In addition to demographic factors, the strong growth in the percutaneous vertebral augmentation (PVA) segment was a major driver. Reimbursement conditions have improved in Switzerland, France, and the Nordic countries, where growth had previously dampened. PVA carries a higher average selling price (ASP) than vertebroplasty treatments but has sometimes demonstrated better results, generating interest among physicians.

Interbody devices, thoracolumbar fixation, and cervical fixation all retain consistent growth rates and will see compound annual growth rates (CAGRs) between 2 percent and 4 percent. Traditional interbody devices saw strongest growth in expandable devices, as well as the general metal material segment. The thoracolumbar fixation segment is expected to see its strongest growth in the trauma/tumor segment. Growth in the cervical fixation market occurred in both anterior and posterior devices.

Innovation Continues Despite Limiters In Materials, Motion Preservation

In recent years, the interbody device market has seen a resurgence of metal devices after a previous move toward PEEK (polyetheretherketone). While PEEK offers less expensive options, metal devices are more durable. For similar reasons, the market has seen the appearance and growth of titanium-coated PEEK devices, also called Ti-coated or Ti-PEEK. The metal device segment saw stronger growth at a CAGR approaching 5 percent; meanwhile, the PEEK and machined bone segments had CAGRs of under 3 percent and under 1 percent, respectively. 3D-printed devices are beginning to generate interest and are expected to become an emerging technology over the forecast period.

Motion preservation devices have seen lower growth in the European markets than in other regions, such as the United States. Lack of reimbursement has been a major limiter for this market, particularly for lumbar artificial discs. This is due to restricted indications that only allow for more invasive posterior implantations. However, future devices are expected to see broader indications. Furthermore, cervical discs are expected to see higher growth.

Similar restrictions and device safety concerns have limited growth in the dynamic stabilization segments. Medtronic’s Agile® dynamic stabilization system was recalled in 2007, and the next several years saw a slowdown in the market. Physicians questioned product efficacy and the invasiveness of the procedure. Manufacturers of these products will need to continue improving technology and achieving positive clinical results for growth to increase over the long term.

Minimally Invasive Spinal Segments Experiencing Strongest Growth

Minimally invasive devices experienced stronger growth in most segments than the traditional market. The exceptions to this were spinous process and facet fixation, which face competition from the more established MIS pedicle screw fixation market, another minimally invasive segment. As in traditional devices, a growing elderly demographic will increase unit sales and investment. Another driver is the fact that patients are more willing to choose minimally invasive options when given the choice. Conversely, the complexity of minimally invasive procedures and insufficient reimbursement for the higher-priced devices remain limiters for these markets.

MIS interbody devices were among the fastest-growing minimally invasive segments, with a CAGR approaching 10 percent. This growth has been spurred by the increasing popularity of lateral lumbar (LLIF) devices and the increasing use of oblique approach (OLIF) devices. In addition, the somewhat older minimally invasive posterior lumbar interbody fusion (MIPLIF) and transforaminal lumbar interbody fusion (MITLIF) devices are also expected to see regular increases in unit sales. MIS pedicle screws experienced growth in both the retractor and percutaneous segments. It is expected that the increasing adaption of percutaneous systems to deformity procedures will be a driver. Thus, the percutaneous segment is expected to see slightly higher growth at a CAGR approaching 9 percent.

In addition to these large segments, there were several smaller markets including those mentioned above. In addition, the MIS sacroiliac (SI) joint fusion segment has seen growth with improvements in reimbursement. Likewise, the spinal endoscopy market saw greater growth in Europe than in other regions, due in part to the more widespread use of endoscopes in spinal procedures.

Medtronic, DePuy Synthes Lead Traditional Segments; NuVasive Strong Performer In MIS

Medtronic was the overall market leader for the traditional spinal device industry, with DePuy Synthes continuing to be a close competitor since the merger that established it. At an overall share of approximately 25 percent, Medtronic in fact held smaller shares in several segments than DePuy Synthes. However, Medtronic’s strong presence in the VCF segment gave it a slightly larger overall share. DePuy Synthes held leading shares by significant margins in the cervical fixation and interbody device markets, as well.

These same companies were market leaders in the minimally invasive segments. However, the emerging nature of many of these technologies means that smaller companies can present a greater threat and can gain share in shorter periods of time. NuVasive in particular has seen consistently strong performance and was among the top competitors in several MIS segments. Two segments saw exceptions to this. The MIS SI joint fusion segment saw a majority share held by SI-Bone, the major company selling this technology. Major companies selling endoscopes used in spinal procedures included Karl Storz, Richard Wolf, and Joimax.

About The Authors:

Ash Milton is a market research analyst at iData Research and works with the company’s orthopedic division. He has completed research on spinal orthopedic markets around the globe, including traditional and minimally invasive spinal implants, motion preservation spine devices, VCF treatment, and others.

Kamran Zamanian, Ph.D., is a senior partner and CEO at iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research (www.idataresearch.com) is an international market research and consulting firm, dedicated to providing the best in business intelligence for the medical device industry. Our research empowers our clients by providing them with the necessary tools to achieve their goals and do it right the first time. iData covers research in: wound management, orthopedic soft tissue, orthopedic biomaterials, orthopedic soft tissue reinforcement and regeneration, spinal implants and VCF, spinal MIS, orthopedic trauma, large and small joints, dental operatory equipment, dental material, dental lasers, dental prosthetics, dental CAD/CAM, dental bone graft substitutes, ultrasound, X-ray imaging, diagnostic imaging, oncology, ophthalmics, vascular access, laparoscopy, urology, gynecology, endoscopy, interventional cardiology, cardiac surgery, cardiac rhythm management, electrophysiology, operating room equipment, surgical microscopes, robotics and surgical navigation, anesthesiology, orthopedics and more.

We have built a reputation and earned our clients’ trust based on consistent and uniquely intelligent research that allows our customers to make confident decisions and impact their businesses. A combination of market expertise and over a decade of experience has resulted in a deep understanding of the medical device industry that has inspired innovation and propelled our clients to success.

References:

Europe Market Report Suite for Spinal Implants and VCF 2017 – MedSuite – iData Research Inc.

Europe Market Report Suite for Minimally Invasive Spinal Implant 2017 – MedSuite – iData Research Inc.