Trends In Medical Device Contract Manufacturing — What Medtech OEMs Need To Know

By Carlo Stimamiglio, Alira Health

In the past decade, the relationships between medical device original equipment manufacturers (OEMs) and contract development and manufacturing organizations (CDMOs) have undergone remarkable changes. Continuous pursuit of cost savings and operational efficiencies by medtech-branded manufacturers has increased demand for third-party services. The global medical device outsourcing market, worth an estimated $52B in 2019, is projected to grow at an 11.4 percent CAGR through 2025, outperforming overall medical device industry growth (6.8 percent CAGR).1

Consequently, the organizational, business, and competency models of outsourcing organizations, as well as the types of client-vendor engagement, are evolving to define novel paradigms.

How The Role Of CDMOs Has Evolved

Medical device OEMs have always relied on third-party vendors to pursue cost-competitive sourcing and operational agility. However, the volume of outsourcing has significantly increased recently as OEMs farm out greater portions of the product value chain, including value-add activities originally maintained in-house.

This trend can be characterized by a historical chronology:

- Before 2010: Outsourcing of Low Value-Add Activities — Until the 2000s, it was common for branded manufacturers to maintain captive control of the product value chain. The main outsourced activities consisted of materials sourcing and components manufacturing provided by specialized suppliers of services like injection molding, extrusion, metal processing, and electronics assembly.

- 2010-2020: Leaner Operations, Greater Outsourcing — In the 2010s, OEMs began to farm out greater segments of their operations, contracting full-cycle CDMOs able to integrate design, component manufacturing, and assembly of finished devices. While medical device OEMs continued to keep strategic and IP-protected competencies in-house, CDMOs increasingly developed vertically integrated competences to meet market demand.

- Today and Beyond: Partnerships Founded in Know-How — While the financial and competitive pressures to achieve a variable cost are as high as ever and continue to drive outsourcing demand, medical device OEMs now leverage external vendors beyond supply chain optimization. CDMOs are now critical enablers of the industry’s true strategic mission: medical device innovation:

- Product Innovation, by bridging the OEMs’ competency gaps in new markets or technologies.

- Process innovation, by offering mastery of sophisticated processing techniques, miniaturization, and novel materials combined with quality and scalability — ultimately reducing cost.

The importance of CDMOs has, therefore, continued to grow, powering a transformation of the industry landscape and its competitive dynamics.

Current Medical Device CDMO Trends

As demand for outsourced development and manufacturing services has extended to high value-add segments of the medical device supply chain, OEMs’ vendor selection criteria have become more stringent. In response to the greater standards of quality, price competitiveness, scalability, and technological competencies demanded by customers, contract manufacturers have become larger, more technically advanced, and more vertically integrated.

In the past decade, numerous CDMO mergers and acquisitions (M&A) have accelerated this transformation. Additionally, corporate- and private equity-backed CDMOs have strived to grow and acquire strategic competences through inorganic initiatives, focusing on three main strategies:

- Capacity and Footprint — The pursuit of greater capacity is a common goal among M&A deals as CDMOs seek large-scale manufacturing capabilities and shadow their customers’ global footprint.

- Vertical Integration — Vendors with a specialized focus strive to develop full-cycle capabilities to capture a two-fold opportunity: (1) to benefit their OEM customers by consolidating and simplifying many supply chain steps, and (2) to capture more value from individual customer relationships and grow profitability. Examples include both downstream (i.e., an injection molding company developing or acquiring assembly capabilities) and upstream (i.e., a manufacturing specialist acquiring product design and development know-how to serve customers earlier in the product life cycle) integration.

- High-Tech Innovation — CDMOs seek to differentiate themselves by developing sophisticated and technology-driven competences, as well as by building expertise in specific applications or manufacturing techniques that could attract long-term business.

Such strategies power a fast-paced M&A trend that expected to continue in coming years. Still, despite significant consolidation, the CDMO industry remains fragmented and features a limited group of large global players next to a multitude of smaller, regional, and specialized vendors.

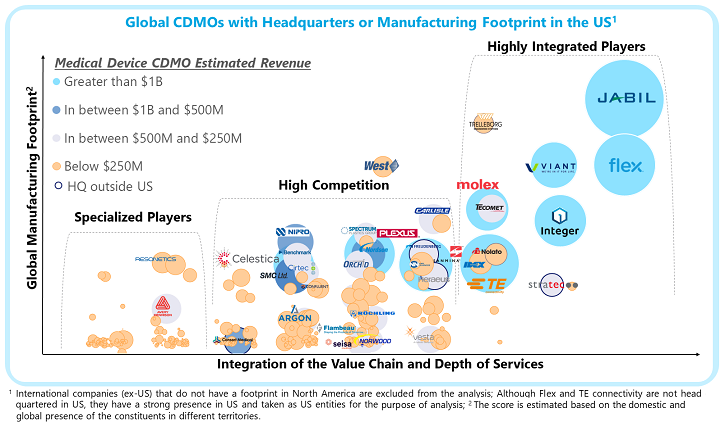

In a recent study published in collaboration with MassMEDIC, Alira Health analyzed 300 medtech contract manufacturers with a domicile or an operational footprint in the U.S. (The study did not cover international CDMOs that do not have a presence in the U.S., estimated to represent 45 percent of the global market.) The top 10 players in this pool, with revenue over $600 million, represent 24.9 percent of the global CDMO market. The next group of 50 mid-sized players, with revenue between $100 and $600 million, combines for a 22.5 percent share. The smallest 220 companies, with less than $100 million in revenue, account for an aggregate 7.2 percent share. (Some of the CDMOs studied do not report financial data and so could not be categorized by revenue.)

This fragmented landscape is expected to become more concentrated as market demands force low value-add manufacturers to either grow and develop new capabilities or go out of business.

Investment And M&A In Medtech Contract Manufacturing

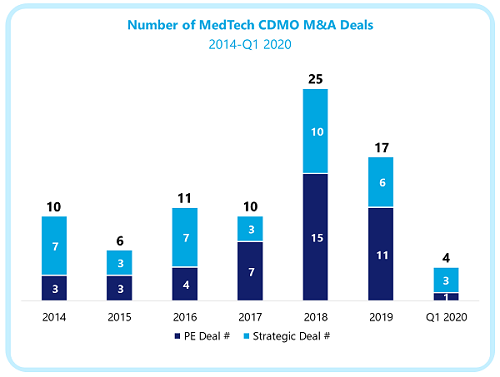

Between 2014 and the first half of 2020, medical device CDMOs have executed 84 M&A deals. Private equity-backed organizations have a slight edge in this activity (44 deals) versus corporate acquirers. Financial sponsors have been attracted by the availability of independent acquisition targets featuring high-growth potential, and thus the prospect of large returns on investment.

A first wave of private equity-backed CDMOs — including Vention, Creganna Medical, Lake Region Medical, and Phillips-Medisize — generated high-profile strategic exits in the mid-2010s. Following these successful initiatives, an unprecedented number of financial investors have entered the medtech CDMO space. This trend seems to have accelerated in the last few years.

Of the 26 private equity-owned CDMOs currently active, 12 have been created since 2018, and these players will spearhead a high volume of M&A deals in the early 2020s. Meanwhile, several platforms established before 2016 are expected to drive large private or IPO exits in the next few years.

Such a vibrant investment and M&A climate contributes positively to the growth and technological development of the medtech contract manufacturing industry. Motivated by financial returns, private equity investors strive to buy and build outsourcing platforms with differentiated capabilities and strong growth prospects, founded in technical savvy and competitiveness. By taking over and growing independent CDMOs with investments in innovation, vertical integration, and globalization, private equity investors have been a major force in the industry transformation.

How These Trends Impact Medical Device OEMs

The evolution of medtech CDMOs into global, technology-driven service providers is great news for medical device companies. When contracting third-party vendors, OEMs prioritize quality, long-term stability (sustainability), and cost efficiency. Inevitably, contract manufacturers able to produce large product or part volumes with high quality, while still delivering cost savings, are preferred partners.

This paradigm serves four areas of value for OEMs:

- Faster Innovation — As medical device makers prioritize technology innovation to open new market opportunities and achieve a competitive advantage, they must supplement in-house expertise with CDMO expertise to bridge potential competency gaps. This need is particularly relevant in the areas of digital and software innovation, which traditionally fall outside the medtech industry’s core competences.

- Time to Market — CDMOs that can serve their customers’ global supply chain by operating in proximity to both the product’s target market and the OEM’s premises offer a great advantage. By simplifying product logistics, these vendors can accelerate the time to market and enable savings of both operational and inventory costs.

- Risk Management — Business continuity and product quality are the medical device industry’s principal risk factors. Adverse events affecting either have tremendous financial consequences for medical device OEMs. Business continuity risk emerged as a clear threat during the initial phase of the COVID-19 pandemic, as global supply chains were disrupted by regional lockdowns, causing product shortages worldwide. CDMOs that operate in close partnership with the OEM operations, not only by aligning quality and logistics systems but also by offering redundant product sources at a variable cost, create tremendous value for their customers.

- Overall Return On Investment — De-leveraging the fixed cost structure in favor of an agile approach to product and component sourcing is a perennial goal for medical device OEMs. While outsourcing organizations have historically provided such operational and financial flexibility, the client-vendor engagement models are evolving into more sophisticated two-way partnerships. CDMOs are becoming an extension of captive operations.

Direct OEM capital investments in technology and equipment for outsourcing facilities are now frequent and aim to guarantee product quality and efficiency. Shared financial and risk-management goals between clients and vendors are also replacing traditional fixed-price agreements. This evolution is poised to generate long-term economic value for medical device OEMs while maintaining the benefits of a variable cost structure.

Trends that have characterized the medtech contract manufacturing industry in recent years continue in full force today. While client-vendor relationships are charged with complexities — particularly related to pricing and the management of regional and redundant suppliers — the fundamental trajectory is one of mutual growth and benefit for medical device CDMOs and OEMs.

References:

About The Author:

Carlo Stimamiglio is a partner in Alira Health’s Transaction Advisory practice and focuses on helping medical device, digital health, and pharmaceutical companies in the execution of strategic and M&A deals. Besides his focus on healthcare technologies, Stimamiglio is a leader of Alira Health’s Contract Manufacturing specialty practice and has been an active strategy and transaction advisor to global CDMOs. He is a registered investment banker with FINRA Series 79 and 63 licenses, and he earned an MS in finance from the University of Verona and an MBA from IE Business School.

Carlo Stimamiglio is a partner in Alira Health’s Transaction Advisory practice and focuses on helping medical device, digital health, and pharmaceutical companies in the execution of strategic and M&A deals. Besides his focus on healthcare technologies, Stimamiglio is a leader of Alira Health’s Contract Manufacturing specialty practice and has been an active strategy and transaction advisor to global CDMOs. He is a registered investment banker with FINRA Series 79 and 63 licenses, and he earned an MS in finance from the University of Verona and an MBA from IE Business School.