U.S. Cancer Epidemic Leads To Strong Growth In Cancer Treatment Market

By Kamran Zamanian, Ph.D, and Scott McInnes, iData Research Inc.

The American market for interventional oncology (IO) devices is a large, diverse, and changing, encompassing many different methodological approaches to the treatment of cancer. In 2015, the IO market was valued at over $3 billion USD. Included in our analysis are the markets for external radiation therapy devices, internal radiation therapy devices, ablation devices, and particle embolization devices.

different methodological approaches to the treatment of cancer. In 2015, the IO market was valued at over $3 billion USD. Included in our analysis are the markets for external radiation therapy devices, internal radiation therapy devices, ablation devices, and particle embolization devices.

While the market is in a relatively stable state, expected fluctuations in the external radiation segment have had a strong impact on the overall forecast. In 2015, the market for linear particle accelerators (LinAccs) was over 60 percent of the entire IO market. One of the common denominators underlying the various segments of the IO market is the increase in the potential patient base.

Cancer Epidemic

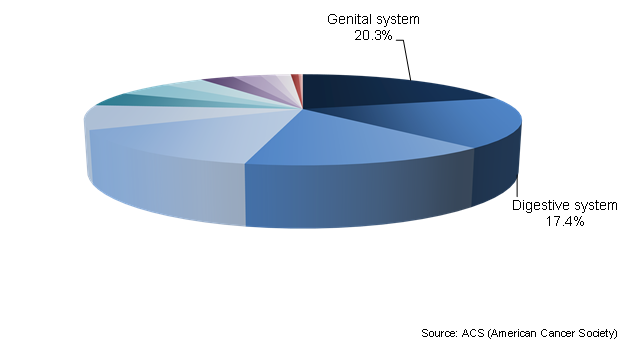

As the cancer epidemic continues, the patient base for the IO market increases accordingly. Each year, over 14 million people are diagnosed with cancer around the world. In 2014, there were over 1.5 million cancer diagnoses and more than a half million deaths in the U.S. alone. Cancer ranks as the number two cause of death in the U.S. behind heart disease, and the amount of diagnoses is set to increase over the foreseeable future. An aging American population, combined with an increase in detection technologies, will also add to the total U.S. patient base.

External Radiation Devices Remain The Largest Market

In 2015, the external radiation (RTx) segment was by far the largest segment of the IO market. The RTx market is divided into LinLinAccs and proton therapy (PT) devices. While it is true that cobalt-60 (Co-60) machines are sometimes used, the U.S. market for these devices is virtually non-existent. The market for these devices is thriving in less-developed countries, but they have been almost entirely replaced by LinAccs in the United States. Having reached saturation a few years ago, the market for LinAccs is almost entirely made up of replacements. Proton devices are the new and upcoming technology in the field of RTx.

PT devices have been making steady inroads in the U.S. As an early adopting ground for growth, the U.S. often receives new technologies before they spread out across the globe. As of the end of 2015, 22 PT centers were scheduled to be in operation in the U.S. PT devices have a monumental price tag: Some machines can range upwards of $200 million, making them, by far, the most expensive piece of medical equipment ever created. For example, the Mayo Clinic in Minnesota spent $370 million building its two machines. Until recently, this technology was limited to large facilities.

However, companies have been making serious inroads in developing more cost-effective options. Mevion Medical Systems’ s250 is dominating the market in terms of future growth. While only one is currently in operation, Mevion leads the market with 33 percent of the planned facilities expecting to use the s250. Varian Medical Systems has also been attempting to pioneer a new compact form of its ProBeam.

Internal Radiation Market Set To Recover By 2022

While the internal radiation (RTi) segment has been in a general decline, it is set to recover considerably over the report’s forecast period. The RTi market is divided into high-dose-rate (HDR) products and low-dose-rate (LDR) products. The newest RTi modality, pulse-dose-rate (PDR), is not yet used in any considerable way within the United States, but is much more common in Europe.

One of the largest limiters for the LDR market had been the reduction in PSA tests. In 2012, several national U.S. authorities issued a statement advising against PSA testing for prostate cancer in asymptomatic men. This led to reductions in all LDR sub-segments. Total units sold of LDR seeds (Cesium-131, Palladium-103, and Iodine-125) and needles fell equally, as 90-95 percent of all LDR treatments administered were being used on prostate cancer.

However, as the health care model in the U.S. undergoes dramatic reform, it is predicted that both the LDR and HDR modalities will undergo substantial growth as they are provided new avenues to expand. In 2013, a push toward reimbursement based on “bundled payments” began. When a patient requires care for a specific issue, the bundle is defined as the group of treatments or services provided to the patient so that they may be restored to optimal health. This system places brachytherapy ahead of other modalities in a much more cost-efficient position. In addition, as a result of the Affordable Care Act (ACA), millions of previously uninsured Americans now have insurance. Both of these drivers will add substantially to the demand for RTi procedures.

The Need For Ablation Therapy

The market for ablation — a market that includes cryoablation, microwave ablation, and radiofrequency (RF) ablation — has been characterized by intense competition. In the U.S., there are approximately 600 ablation sites. Many sites offer all three modalities, while others may only offer one. However, even though there are 600 sites, 80 percent of all the ablation procedures in the U.S. are performed by only one-third of the sites.

The average site performs 2.5 ablation procedures per month (all modalities combined), while high-volume sites perform an average of three to four ablation procedures per week. What this means for the marketplace is that the list price is not indicative of the market size. These large-scale, high-volume sites receive substantial discounts in their purchases of both disposables and capital equipment; many of them receive capital equipment for free in exchange for buying a certain amount of disposables per annum. These deals are called “royalty free” agreements and distort the map of the market.

Particle Embolics Market Experiencing Massive Growth

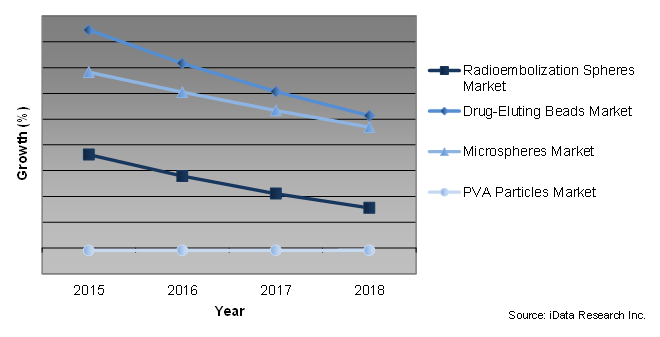

The market for particle embolics has been growing at a dramatic pace. Of all four segments studied and surveyed, particle embolics is the fastest-growing. The particle market is segmented into radio-embolization spheres, drug-eluting beads (DEBs), microspheres, and polyvinyl alcohol (PVA) particles.

Growth in the microspheres and DEBs has been especially large. On the microspheres side, growth is attributed to both patient and practitioner factors. On the patient side, there is a greater awareness of microspheres as an alternative to surgery for uterine fibroids. Although not a true oncological indication, this is nonetheless the driving force behind unit sales of microspheres. On the practitioner side, microspheres are the gold standard in embolization. As such, nearly all physicians are trained on and comfortable with performing microsphere procedures as opposed to other modalities. On the DEB side, a greater ability to diagnose inoperable liver cancer has led to an increase in demand for the procedure.

While microspheres and DEBs were the fastest-growing segments, the radio-embolization sphere segment was the largest of the four analyzed for 2015. A large ASP, combined with SirTex Medical’s active marketing campaigns to promote the industry, has led to both high growth rates and high market values. However, over the forecast period, growth is expected to level off as SirTex exhausts its indications. In addition, radio-embolization as a whole currently enjoys a very generous reimbursement policy. If this changes, it will have an immediate, substantial negative effect on the market.

Conclusion

The market for IO devices is large and diverse. As the potential client base increases, avenues for growth will be presented. However, given the scope of the U.S. cancer epidemic, competition between the different modalities will be stiff. These different modalities will be competing for market share, which may put downward pressure on prices across the board. Growth in the market depends upon effective marketing, favorable reimbursement, and positive clinical data. From this analysis, one thing is clear: As cancer rates increase, the demand for modalities will increase accordingly, as treatment is non-elective.

About The Authors

Scott McInnes is a research analyst at iData Research and was lead researcher for the 2015 European Orthopedic Biomaterials Market. He currently is working on the 2015 U.S. Market for Oncology Diagnostic and Intervention Devices. Connect with Scott on LinkedIn or contact him at scottm@idataresearch.net.

Kamran Zamanian, Ph.D., is president, CEO, and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

Resources

- US Interventional Oncology Device Market Report Suite – 2016. iData Research. http://idataresearch.com/us-interventional-oncology-device-market/. Accessed February 26, 2016.

- US Cancer Incidence Rates – 2014. American Cancer Society. http://www.cancer.org/research/cancerfactsstatistics/cancerfactsfigures2014/. Accessed February 26, 2016.