U.S. Large Joint Repair: Market Trends

By Kasra Kazemi Ashtiani and Kamran Zamanian, iData Research

At the end of 2019 and in early 2020, the emergence of the COVID-19 pandemic hit many industries and caused them to experience drops in their market values. With the development of different vaccines and the hope of a future with lesser impacts from the pandemic, many industries started to recover from severe losses in market value. As the number of vaccinated people increased day by day, the recovery became stronger. The United States’ large joint repair market wasn’t an exception. The double-digit growth in many segments of this market was the result of a recovery from the impact of COVID-19 on the market. The double-digit growth in 2021 and an expected high single-digit growth in 2022 forecasts that most segments of this market will fully recover and catch up on some forgone growth by the end of 2022.

All segments of the U.S. large joint repair market experienced double-digit growth in 2021. This growth allowed the knee replacement, hip replacement, and bone cement markets to fully recover from the impacts of the COVID-19 pandemic and grow past the pre-pandemic values by 2022.

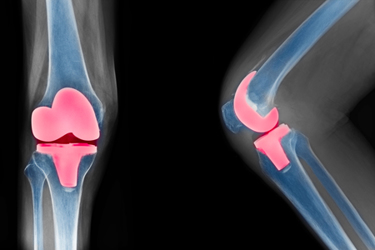

Knee Replacement Device Market

Knee replacement procedures are the most common large joint replacement procedures in the United States. The most common knee replacement procedure in the U.S. market is total knee replacement, which includes the majority of the total market value. Before the pandemic, knee replacement procedures trended toward a mid-single-digit growth rate. After the COVID-19 pandemic led to a double-digit decline in the number of procedures in 2020, knee replacement procedures rebounded in 2021 with double-digit growth. 2022 is also expected to experience a higher-than-usual growth rate as procedures are still catching up on some foregone growth during the pandemic. The majority of these procedures took place in hospitals and only a small portion of the procedures took place in alternate care settings.

The number of units sold in the knee replacement device market increased at a double-digit rate in 2021. The market is expected to experience another year of high growth rates in the number of units sold in 2022 and then return to the mid-single-rate growth rate going forward. The drop in the average selling price couldn’t completely offset the rise in the number of units sold, resulting in a double-digit growth rate in 2021. The growth rate in the market value is expected to return to a low-single-digit rate from 2023 onward.

While the majority of knee replacement procedures are done in the hospital setting, the trend is in favor of the alternate care setting – a trend that is increasing year over year. This trend can be seen in every subsegment of the knee replacement market. On average in the large joints market, around 5%-10% of the surgeries happen in alternate care settings. Partial knee replacement, however, has a higher rate of alternate care uptake.

One of the most important trends in the knee replacement market is that surgeons are moving toward cementless total knee replacement procedures rather than cemented total knee replacement procedures. The cemented market, although it has existed for at least two decades longer than the cementless market, is expected to lose some of its market share as more advanced cementless technologies are developed. The growing use of 3D-printing technology in orthopedics will fuel the cementless knee replacement market. The use of cementless devices saves time during surgery and so is more attractive to surgeons. For cemented devices, the surgeon must premix the cement mixture immediately before placing the implant into the patient. However, since there have been no clinical studies that demonstrate that cementless knee implants are clearly superior, the cemented implants will remain the preferred option in total knee arthroplasty over the forecast period. Additionally, cementless implants cannot be used in some cases, such as for patients with poor bone quality. Hybrid implants combine a cemented femoral component with a cementless tibial side and are gaining popularity in the knee replacement market. The market for hybrid implants will grow over the forecast period.

Hip Replacement Device Market

The most common hip replacement procedure in 2021 in the U.S. market was total hip replacement. Total hip replacement procedures are expected to continue to increase in share year over year, while the procedure share for partial hip replacement and hip resurfacing is expected to decrease. The hip replacement revision procedure share is expected to remain stagnant.

The vast majority of hip replacement procedures in the U.S. market in 2021 took place in the hospital setting; however, the share of alternate care is increasing year over year, with a cumulative annual growth rate (CAGR) forecasted to be more than three times as high from 2021-2028. The share of procedures that take place in hospital care settings is still expected to include the vast majority of the hip replacement procedures over the forecast period.

Unlike knee replacement procedures, most total hip replacement procedures were cementless total hip replacement. Cementless hip replacement procedures are expected to continue growing in share, while cemented and hybrid hip replacement procedures are experiencing declines in their shares. All three of these segments are expected to experience increases in the number of procedures performed in alternate care settings as compared to the hospital setting.

The number of units sold increased in the total hip replacement device market in 2021 in the U.S. market with a double-digit growth rate. The growth rate is expected to decline to a high-single-digit growth in 2022, before it goes back to a low-single-digit growth rate. A decrease in the average selling price and an increase in the number of units sold led to a low-single-digit growth in the market value in 2021. The market is expected to grow at a low-single-digit rate over the forecast period.

Bone Cement Market

The bone cement market is broken down into traditional and premixed antibiotic segments. The majority of the market was dedicated to the premixed antibiotic bone cement segment in 2021. The traditional bone cement market is expected to increase only minimally over the forecast period, with a low-single-digit growth rate for market value, while the premixed antibiotic bone cement market is expected to decline starting in 2023, after recovering from the impacts of COVID-19.

Although usage continues to grow, bone cement has been overshadowed by cementless, or press-fitted systems. The primary drawback of bone cement is that it is not effective in promoting bone growth around and into implants, which is the ideal method of fixation. Bone cement actually destroys a small portion of a patient’s existing bone stock, but this is offset by the benefit of having superior short-term post-surgical fixation. However, press-fitted implants tend to do better over the long term, where the chance of the implant loosening is mitigated by the superior adhesion of the body’s natural bone to the surface of the implant.

In the U.S. market, Stryker, Zimmer Biomet, Heraeus, DePuy Synthes, and Colfax Corp. are the leaders of the bone cement market. Other companies, such as Exactech, Kyeron, and Smith and Nephew, also compete in the market.

About The Authors:

Kasra Kazemi Ashtiani is a research analyst at iData Research. He analyzes data for syndicated research projects regarding the medical device industry, and he assisted with the publication of the report The Orthopedic Surgery Device Market.

Kasra Kazemi Ashtiani is a research analyst at iData Research. He analyzes data for syndicated research projects regarding the medical device industry, and he assisted with the publication of the report The Orthopedic Surgery Device Market.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.