US Interventional Cardiology: 2 Segments Showing Greatest Market Growth

By Emily Gilbert and Kamran Zamanian, Ph.D., iData Research

Coronary artery disease (CAD) is a multifaceted disease that demands various approaches in terms of diagnosis and treatment options. Devices for the diagnosis and treatment of CAD can be of high volume and low cost or of a relatively low volume and high cost. The U.S. interventional cardiology market, worth over $3.5 billion, is currently being influenced by technological innovation and consolidation. The high rate of research and development in the interventional cardiology market will continue to push innovations forward and market value upward.

Two markets seeing the most benefit from research are drug-eluting stents and intravascular imaging. These segments are relatively new in the mature market and are seen as more premium products due to their higher costs. However, increasing positive clinical evidence is giving these segments a permanent spot in the market. The improved clinical outcomes provide cost-saving benefits, driving growth across the two market segments. The first drug-eluting stent, sirolimus-eluting Cypher stent, was approved by the FDA in 2003. By 2010 Abbott was introducing the first FDA approved optical coherence tomography (OCT) system for intravascular imaging.

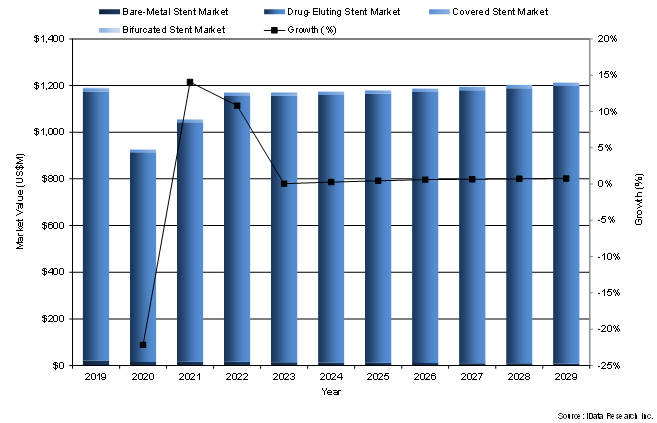

The COVID-19 pandemic had a temporary impact on the market. A significant portion of interventional cardiology procedures are considered elective, which meant that at the peak of the pandemic a large volume of procedures were cancelled. In 2022, procedures returned to pre-pandemic numbers and growth trends that are expected to be sustained over the reporting period. This report edition provides a market forecast through 2029.

The Switch To Drug-Eluting Stents

Stent placement remains a central treatment for interventional cardiology procedures. The use of bare-metal stents was standard for many physicians. However, in recent years all the major companies in the segment have had drug-eluting stents approved by the FDA, including the Xience line from Abbott and Synergy and Promus products from Boston Scientific. A drug-eluting stent is coated with a slow-release medication to help prevent blood clots from forming in a stent. The new drug-eluting stents have been shown to have a significantly lower rate of complications and now are the preferred stent of physicians.

The shift in medical acceptance has led to drug-eluting stents representing the majority of the coronary stent market. In addition, some longstanding bare-metal stents are being pulled off the market as companies continue to invest into the drug-eluting stent market. The presence of drug-eluting stents on the market has also resulted in a reduction in the already niche market of covered stents. Covered stents are primarily used to fix stent stenosis and other complications post stent placement. Drug-eluting stents have been shown to reduce all major post stent complications, including stenosis, driving the drop in the covered stent market. Drug-eluting stents being the new standard for stenting will only grow in the coming years.

An increasing number of companies investing in drug-eluting stents fuels competitive pricing in the segment.

Figure 1: The U.S. Coronary Stent Market Projected Market Value (2019–2029)

The Rising Adoption Of Intravascular Imaging

Intravascular imaging is often performed using a specialized catheter (intravascular ultrasound [IVUS] or optical coherence tomography [OCT]) to confirm appropriate vessel/stent matching and full stent strut expansion and strut apposition (contact without space against the wall). Abbott was first to get FDA approval for its OCT technology in 2010. Since approval, there has been slow adoption of OCT, with Abbott maintaining control of the market. IVUS over the same period has slightly higher adoption than OCT due to Philips’ large portfolio in the space.

Recent changes to the American College of Cardiology clinical guidelines1 highlight the usefulness of the technology. The new guidelines have expanded the number of scenarios in which intravascular imaging can prevent complications like stenosis. Part of the new recommendations is that all cath labs should have intravascular imaging capability. It is expected that these recommendations will result in higher adoption of the technology over the reporting period alongside opportunities to train on using the medical devices.

Despite the device innovations in the intravascular imaging market space, there remain challenges with the financial capital and human capital needed to purchase and operate the devices. However, the limitation of human capital is only short term. Both the public and private sectors have plans to offer training opportunities on using intravascular imaging devices. Rising clinical acceptance has come at a time of new innovative devices in the segment, which are hybrid OCT and IVUS devices. A notable device in this emerging segment is Convai Medical’s Novasight Hybrid. Previously, all devices on the market were either IVUS or OCT. The continual innovations will continue the trend of premium pricing on the console units for both IVUS and OCT. However, as more companies gain FDA approval of their devices the pricing is expected to become more competitive.

Final Thoughts

The interventional cardiology market has seen consistent growth due to the aging population and rising prevalence of heart conditions. This in turn has driven new innovations like drug-eluting stents to reduce the number of complications post surgery. The rise of intravascular imaging allows for increased knowledge of the vessels and their conditions pre- and post-operation. Continual investment in research and development within the interventional cardiology market is expected to fuel expansion in what was a mature market with a declining market value.

In addition to the growth, some markets will be cannibalized, allowing for what was an established market to continue to innovate and expand. The long-standing market segments such as bare-metal and covered stents will face severe reductions and may be completely taken over by drug-eluting stents. Other ultrasound systems that have been used for imaging in the past will likely see a smaller market space but maintain a presence within markets other than interventional cardiology. Out of the cannibalization will emerge a more advanced, higher standard of care for CAD and other heart conditions, giving both patients and medical professionals better outcomes in a growing patient pool.

Reference

- Members, Writing Committee, et al. “2021 ACC/AHA/SCAI Guideline for Coronary Artery Revascularization: A Report of the American College of Cardiology/American Heart Association Joint Committee on Clinical Practice Guidelines.” Journal of the American College of Cardiology, 1 Jan. 2022, https://www.jacc.org/doi/10.1016/j.jacc.2021.09.006?_ga=2.212340508.942214294.1667238880-158521136.1661364022&_gl=1%2A721w1w%2A_ga%2AMTU4NTIxMTM2LjE2NjEzNjQwMjI.%2A_ga_2V8VW4Y237%2AMTY2NzI0MzM3NS44LjAuMTY2NzI0MzM3Ni41OS4wLjA.

About the Authors

Emily Gilbert is a research analyst at iData Research. She develops and composes syndicated research projects regarding the medical device industry, publishing the U.S., EU, and global interventional cardiology series as well as the U.S. and EU cardiac surgery reports.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.