Using Device Strategy To Drive R&D Productivity

By Bill Welch, Phillips-Medisize, and Henrik Leisner & Kevin Deane, Medicom Innovation Partner

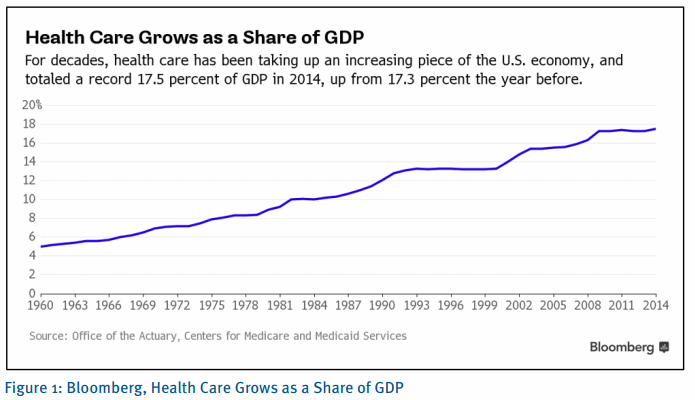

Biopharmaceutical companies face sustained pressure from all sides to develop better products at lower costs, delivering value to patients, payers and shareholders. Healthcare costs are rising globally at an unsustainable level, putting the entire healthcare delivery system under pricing pressure. Biopharmaceutical companies have become popular targets, evidenced by increasing scrutiny on prescription medicine prices, even though spending on medicine accounts for only about ~10% of overall spend.1

This places an ever increasing pressure on biopharmaceutical cost structures, particularly R&D groups, which need to develop truly innovative drugs in new disease areas. Often these disease areas are linked to long-term conditions, requiring active involvement by patients and caregivers.

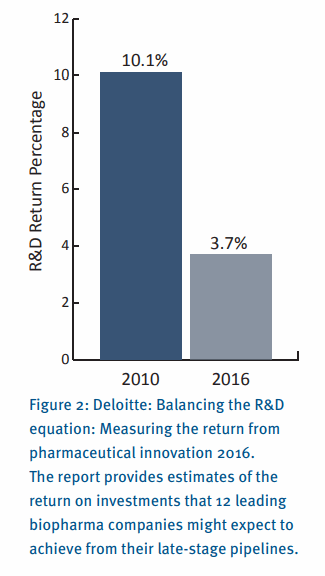

In the face of this challenge, biopharmaceutical companies are experiencing a steady decline in R&D returns.

As the Deloitte report highlights (see Figure 2), R&D costs per asset have stabilized, but the forecast peak sales per asset continue to decline - far fewer assets are considered to have blockbuster status (peak sales greater than 1 billion USD). Pricing is one of the biggest challenges, however addressing unmet clinical needs is also difficult as more drugs are targeting second or third line treatment options.

As the Deloitte report highlights (see Figure 2), R&D costs per asset have stabilized, but the forecast peak sales per asset continue to decline - far fewer assets are considered to have blockbuster status (peak sales greater than 1 billion USD). Pricing is one of the biggest challenges, however addressing unmet clinical needs is also difficult as more drugs are targeting second or third line treatment options.

These two forces are changing the way that biopharmaceutical firms approach drug development, pricing and launch. Firms continue to seek greater efficiency across the board, particularly as the industry moves to ‘payment by result’, with reimbursement based on proving outcomes.

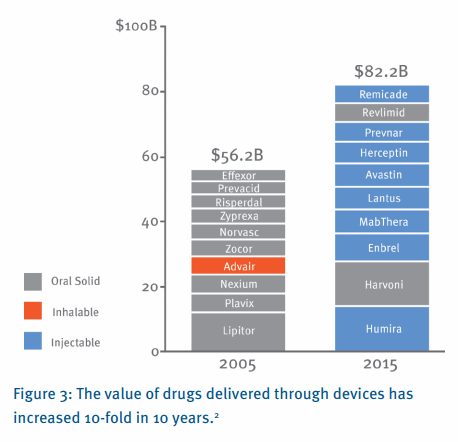

Underneath this backdrop of a challenging industry environment, a smaller revolution has been taking place. Recent drugs, particularly biologics, require new means of administration, moving beyond traditional oral delivery (i.e. tablets and capsules). In most cases, these drugs require more complex delivery devices, which provide the means to administer the drug into the patient. As the chart below indicates, this transformation has been revolutionary. Of the top 10 drugs by global sales revenue in 2015, 8 are liquid formulations requiring some form of injection. This is in stark contrast to the list of top 10 drugs in 2005, all of which were small molecules, with 9 delivered orally. In the space of 10 years, drug delivery devices have moved from niche applications to become a central technology that is core to the competitiveness of most biopharmaceutical companies.

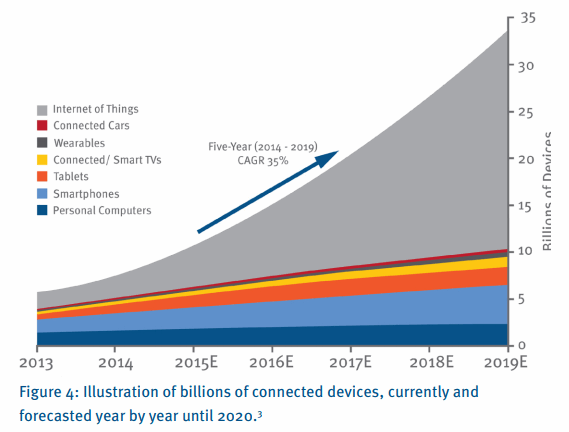

Finally, there is one further trend that is having a significant impact on the way we think about healthcare provision. Connectivity, for lack of a better word, is becoming ubiquitous. There are more connected devices on the planet than people. In fact, this tipping point occurred as far back as 2008. A recent forecast done by BI Intelligence estimates that in 2020 the average person will have 6 ‘Things’ on-line, with most forecasts indicating between 20 billion and 50 billion connected devices by then. The uptake rate of digital infrastructure is occurring at a rate 5 times faster than the adoption rate of electricity and telephones.

The healthcare industry, and specifically drug delivery, will inevitably be caught up in this societal change.

With all of these challenges, how do biopharmaceutical R&D groups respond?

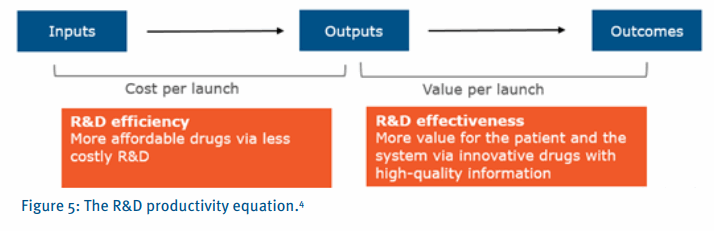

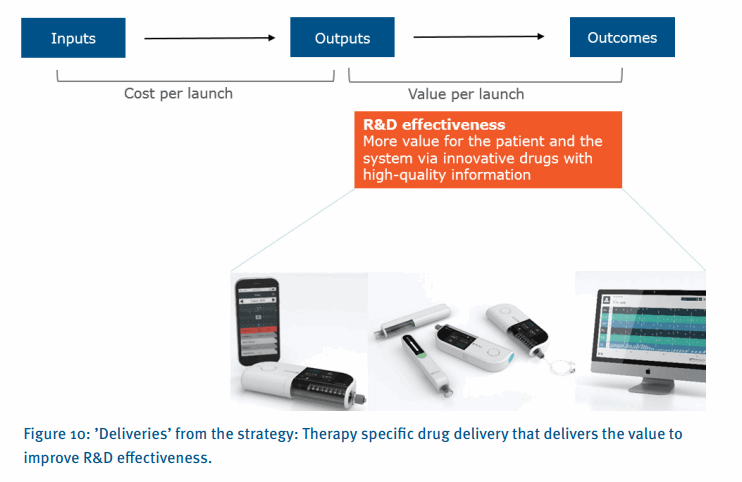

The answer to this question, as highlighted in an article in Nature (Figure 5), is to focus on ‘value per launch’ as opposed to traditional efficiency mechanisms. This article essentially highlights that most biopharmaceutical companies have traditionally focused their R&D productivity improvement efforts on efficiency, reducing the cost per launch, as opposed to effectiveness, increasing the value per launch. To improve R&D productivity, it is crucial to understand the interdependencies between inputs (e.g. R&D investments), output (e.g. new molecular entity launches) and outcomes (e.g. valued outcomes for patients). Figure 5 outlines the key dimensions of R&D productivity and the goals tied to R&D efficiency and effectiveness.

Broadly, R&D productivity is the combination of efficiency and effectiveness. Most companies have placed a great emphasis on efficiency over the past decade, streamlining R&D, outsourcing non-core activities, optimizing global locations and standardizing processes. Effectiveness has, perhaps, received less attention. However, with the recent shift in reimbursement coupled with a stronger emphasis to differentiate on a ‘patient centric’ approach, effectiveness is becoming more important.

This focus on effectiveness is further reinforced in the recent Deloitte document (“Balancing the R&D equation; Measuring the return from Pharmaceutical Innovation”). Deloitte finds that the leading companies have:

- Explicit therapy area focus

- Deep therapy area expertise

- Target populations where value can be maximized

Leading companies also demonstrate value to payers, providers and patients. In the past many of these strategic choices may have been seen as either the sole remit of commercial functions or R&D, but Deloitte finds that market leading product teams integrate value-adding strategies with traditional R&D functions earlier in the R&D value chain. This results in better end-to-end decisions that address all stakeholder needs.

Recognizing the importance of drug delivery devices within a therapy strategy to maximize value

In this emerging world, where competitive advantage is built around specific therapy areas, drug delivery devices targeted to these therapies have a key role to play. For many new drugs, the delivery device is intrinsic to the therapeutic provision. The device plays a critical role in the successful delivery of the drug, impacting effectiveness of the treatment, as device innovations add value and often have the potential to ease treatment documentation.

The device impacts how patients perceive both the drug and the company providing it. This touch-point presents biopharmaceutical companies with an opportunity; an opportunity to better support patients, caregivers and other key stakeholders around the entire care pathway.

To maximize this opportunity, a strategy is required to guide a complete and consistent identification (and delivery) of additional value to the stakeholders.

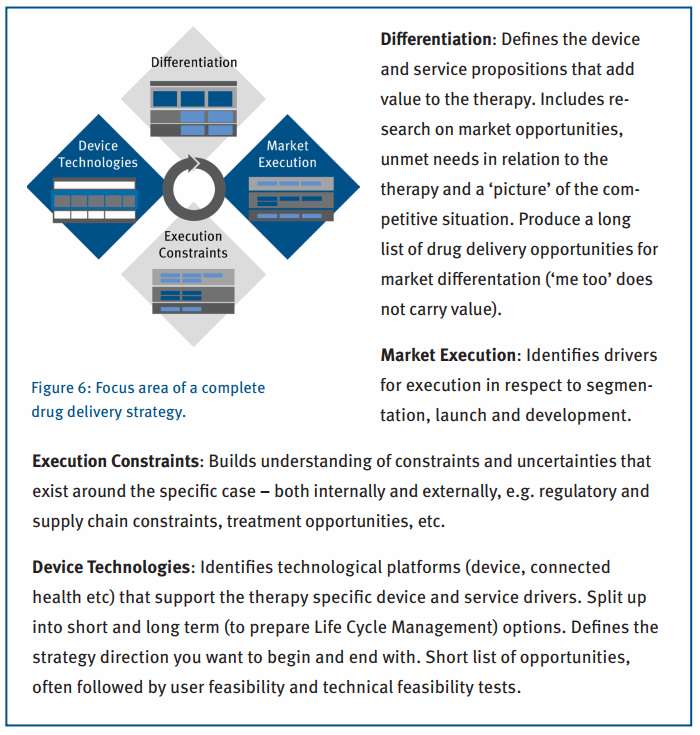

Medicom Innovation Partner (a Phillips-Medisize company) has developed and applied just such a strategic approach, helping biopharmaceutical companies evaluate opportunities across a therapy specific medicinal product. We utilize this approach to identify all the ways the delivery device can support patients and lead to improved outcomes. Figure 6 illustrates the four main aspects a complete and implementable strategy must include.

The strategy is qualified through stakeholder interviews, user research and technical feasibility programs. Technology platforms are put together throughout the process, building therapy specific solutions from existing building blocks that have already demonstrated feasibility.

The innovative process includes workshops with key client personnel. The strategy process from beginning to end is completed within 2-3 months with outcomes such as:

- Short list of therapy specific device opportunities to take through to feasibility testing

- Connected health opportunities to transfer patient treatment data and provide further value add services across the stakeholder community

- Primary packaging definition to match the patient drug administration – or keeping the packaging if that is a constraint

- Identification of life cycle management opportunities built into a roadmap that defines short and long term developments to improve market position in a dynamic environment

Workshops to identify opportunities can be carried out with rapid prototyping to illustrate the workshop result that supports down selection of opportunities for further qualification.

Integrated Device Development – a logical outcome of Device Strategy

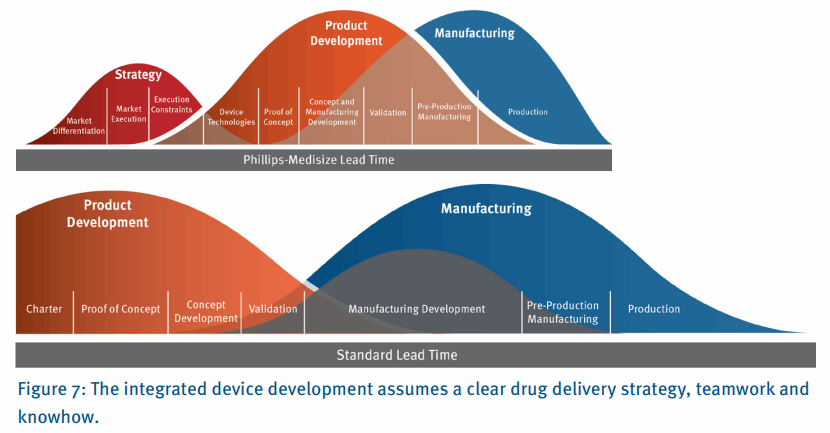

Risks and uncertainties are identified and, where possible, mitigated during the strategy process. These risks then help to shape the device development and industrialization process. By providing continuity of risk management and reducing information loss during slow and costly tech transfer activities, the industrialization process becomes more efficient and predictable:

- Team members continue through the entire project to avoid the time consuming ‘knowledge transfer’

- Design for manufacturing is started early, and fitted to the scale of production

- The technology is based on platforms, meaning technology development takes places outside the device development projects

The integrated development approach enables overall shortening of lead time as illustrated in Figure 7

Summary

By building device strategy into their early commercial thinking, biopharmaceutical companies will develop a deeper understanding of patient needs and a broader view of value to be added across the full care pathway.

The majority of biopharmaceutical companies recognize the growing importance of drug delivery devices. Some are well established in this space; others are relatively new. As all companies look to improve R&D productivity, and effectiveness becomes as important a measure as efficiency, early planning of therapy specific devices will often hold the key to unlocking greater value and improving the outcome of therapy specific medicines.

Adopting a device and service strategy will help companies develop products that not only provide proven therapeutic benefit, but also better support patient needs, improve the support provided to patients by other stakeholders, build a greater understanding of outcome (and how to improve it) and ultimately create more differentiated products that are highly desired by the full range of users. When integrated with a development and manufacturing strategy, this holistic approach drives significant improvements in R&D productivity.

Appendix

Appendix

Case example: Getting into the Care Journey of Multiple Sclerosis to improve outcomes

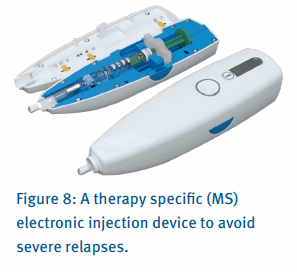

The illustration in figure 8 exemplifies a device and connected service that has been defined, developed and manufactured on basis of the Medicom drug delivery strategy approach.

During the strategy work with stakeholders and patients, the value of avoiding severe relapses was determined as a clear health economics driver. One of the key aspects to accomplish that was to improve patient / HCP interactions and information sharing.

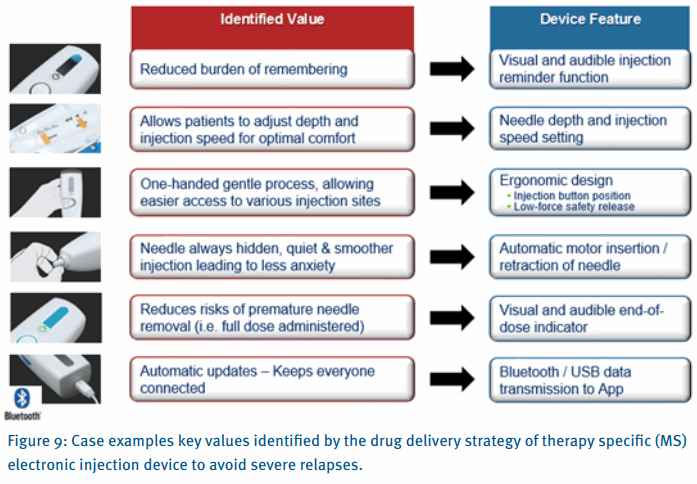

Figure 9 illustrates how the identified values drove the therapy specific features. Off the shelf devices are simply not able to deliver on therapy specific values.

The drug delivery strategy helps biopharmaceutical companies focus on patient value and outcome benefits, driving the improvement of the R&D return.

1 Bloomberg, office of the Actuary, Centers for Medicare and Medicaid Services

2 Pharmaceutical Executive, Vol 36, No. 6

3 BI Intelligence

4 Nature Reviews Drug Delivery 9, 203-214 (March 2010)

…

Click here to download the PDF version.