Uterine Fibroids And Endoscopy: Lack Of Choice In Asia And Oceania

By Fallyn Thompson and Kamran Zamanian PhD, iData Research Inc.

The key finding to the 2017 Asia-Pacific Gynecology Reports by iData Research was a lack of treatment options in gynecology. The problem is that procedures are more likely to be chosen based on procurement and a surgeon’s repertoire, rather than the optimal treatment for the patient’s condition, more so than in Europe or North America. The 2017 reports examine assisted reproduction technology, endometrial resection, uterine fibroid embolization, hysteroscopy, colposcopy, female urinary incontinence slings, pelvic organ prolapse repair devices, and the emerging markets for fluid management equipment and laser technology within the field of gynecology. The capital equipment markets for uterine fibroids and endoscopy are examples of the gaps in education, training, and regulatory barriers to patient safety in the region.

Embolization Monopoly In Japan

Uterine fibroids, or myomas, are the most common pelvic tumor in women. Symptoms vary from patients being asymptomatic to acute pain, depending on the number, size, and location of the fibroid(s). Globally, the most common surgical procedures to treat uterine fibroids are endometrial ablation, endometrial resection, or embolization. Endometrial ablation and endometrial resection are closely linked procedures, and are most likely to limit the number of other types of procedures. For example, in North America and Europe, uterine fibroid embolization (UFE) is less common due to a range of factors, from lack of long-term studies and lack of training to physician preference, as it is more common for interventional radiologists (and not gynecologists) to perform embolization.

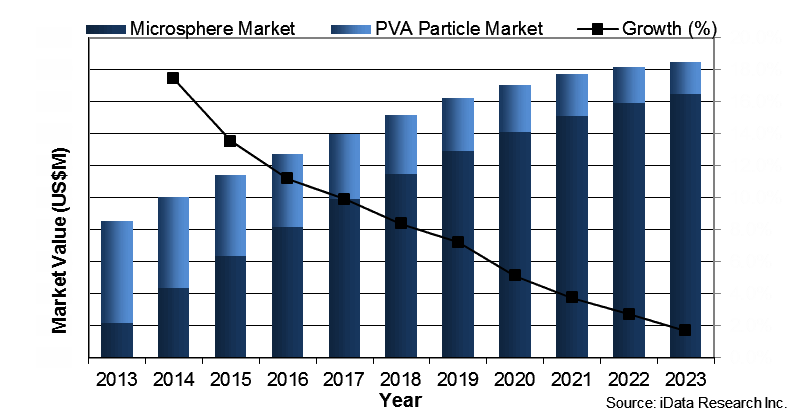

However, in Japan, embolization procedures are trending and are projected to increase exponentially over the next several years. Embolization procedures include transcatheter embolization and occlusion (TEO), interventional neuroradiology (INR), and products fueling the market, such as drug eluting beads (DEB) and radio embolization spheres. In the field of gynecology, the embolization market covers polyvinyl alcohol (PVA) particles and microspheres, as well as a portion of procedures performed using gelatin sponge particles.

The momentum towards embolization procedures was in part triggered by the approval of microspheres to enter the Japanese market in 2013. Specifically, Nippon Kayaku (authorized distributor for Merit Medical Systems, Inc.) received authorization for the distribution and marketing of Embosphere Microspheres and HepaSphere Microspheres in June 2013. Embosphere Microspheres are particularly valuable as “the most clinically studied round embolic [that] provide consistent and predictable results for effective embolization in the treatment of uterine fibroids, hypervascular tumors, and arteriovenous malformations.”1 They often are referred to as the gold standard for UFE procedures.

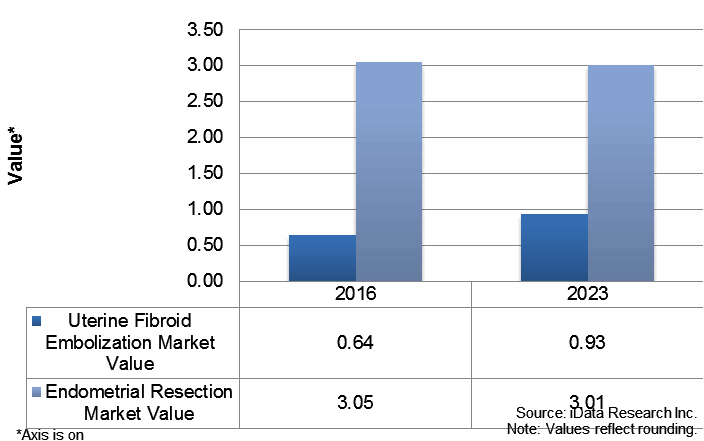

The emphasis on UFE in Asia, and especially Japan, has eroded the endometrial resection market and contributed to the absence of endometrial ablation as an available treatment option. Prioritizing increased education and training will help to grow alternative treatment options. Globally, endometrial ablation is experiencing resurgence due to the ease of use and convenience the procedure offers. Endometrial resection, on the other hand, has the greatest clinical evidence supporting long-term success for the treatment of uterine fibroids — the success rate of endometrial resection to achieve Amenorrhea (no further periods) is 85 percent, with only a 5 percent chance that additional procedure(s) will be required.2 While all countries exhibit trends in physician training and preference, the cause leading to the exclusion and minimal availability of safe, proven methods needs to be addressed.

Endoscopy Advancements Killing Profits

Transitioning away from endometrial resection and ablation procedures further erodes the endoscopy market, in addition to the uterine fibroid treatments available on the market. Gynecological endoscopes include resectoscopes for endometrial resection, hysteroscopes, and colposcopes. In 2016, resectoscope and colposcope sales both were declining, with hysteroscopic procedures only modestly increasing. Furthermore, the hysteroscope market is being eroded as alternative types of endoscopes are being used off-label, in place of a hysteroscope, to perform hysteroscopy procedures.

The endoscopy capital equipment market for gynecology has disproportionately low sales relative to population demographics and number of medical facilities. This is due in part to the gaps in procedures offered; however, it also is triggered by a fundamental shift in the market. As national healthcare budgets are increasingly constrained, manufacturers are releasing versatile product portfolios that are being marketed towards multiple specialties. The tendency to use a cystoscope to perform a hysteroscopy procedure, for example, occurs in a high percentage of cases, and helps to explain why cystoscopes outsell hysteroscopes 20-to-1.

Part of the cause for this trend is the existence of superior quality products. Japan, for example, places a high emphasis on superior optical capabilities, and often prefers higher quality capital equipment, despite the higher price. While this is a positive, higher quality scopes mean lower replacement rates. It also means that fewer scopes are purchased, because the hospital budgets are not increased proportional to the increasingly higher costs for better technology. As a result, fewer pieces of specialty equipment, like gynecological hysteroscopes, are being purchased. These items are becoming redundant, replaced by multi-functional capital equipment.

The Solution

The emphasis to use the correct product in surgery, as opposed to the available option, needs to involve the surgeon in the purchasing process. As more products are being repurposed and used off-label, surgeons have become less involved in the purchasing process. Procurement processes and the influence of hospital tender contracts, both public and private, are increasingly determining the medical capital equipment available within sub-specialties of medicine, and making it progressively harder for surgeons to order their preferred equipment choice.

As a self-reinforcing cycle, the lack of available equipment also is negatively impacting education and training on a more diverse repertoire of treatment options. As surgeons are less familiar with techniques to perform alternative procedures, they also are advocating less to invest in additional equipment. Increased professional development and stress on patient safety and optimal outcomes will help to reverse this trend.

Finally, the regulatory environment and product approval process need to take into account clinical data, and recognize the successful results associated with alternative procedures. As the population continues to age and population pyramids continue to invert and be skewed towards older demographics, patient volumes continue to increase. Fueled by growth in younger generations, decreased stigmatization towards women’s health and sexual health also are increasing patient volumes overall. Changes throughout all levels of hospital supply chains will ensure patient safety and optimal treatment procedures increase, thereby fueling growth in the gynecology capital equipment market in the region.

About The Authors

Fallyn Thompson is a Senior Research Analyst and Endoscopy Team Lead specializing in Women’s Health. Her recent publications include Gynecology reports in Europe, Australia, China and Japan.

Kamran Zamanian, Ph.D., is president, CEO and a founding partner of iData Research. He has spent over 20 years working in the market research industry.

About iData Research

iData Research is an international market research and consulting firm, dedicated to providing the best in business intelligence for the medical device industry. Our research empowers our clients by providing them with the necessary tools to achieve their goals and do it right the first time.

We have built a reputation and earned our clients’ trust based on consistent and uniquely intelligent research that allows our customers to make confident decisions and impact their businesses. A combination of market expertise and over a decade of experience has resulted in a deep understanding of the medical device industry that has inspired innovation and propelled our clients to success.

References

- https://www.merit.com/merit-medical-launches-embosphere-and-hepaspheretm-microspheres-in-japan/

- http://www.cmdrc.com/endomyometrial-resection-emr-vs-endometrial-ablation-ea/

- China Market Report Suite for Gynecological Devices 2017 – MedSuite, iData Research Inc.

- Australia Market Report Suite for Gynecological Devices 2017 – MedSuite, iData Research Inc.

- Japan Market Report Suite for Gynecological Devices 2017 – MedSuite, iData Research Inc.