What Is The Future Of Hysteroscopic Morcellators In The U.S.?

By Federica Cogoni, MA, and Kamran Zamanian, Ph.D., iData Research

Hysteroscopic morcellators systems have emerged as an innovative technology for minimally invasive surgery. Recent evidence has demonstrated the safety and effectiveness of hysteroscopic morcellators as a viable alternative to other instruments such as hysteroscopes and resectoscopes for treating a wide range of intrauterine pathologies, including endometrial polyps and uterine myomas and for the removal of placental remnants. By enabling the simultaneous cutting and removal of tissues, hysteroscopic morcellators offer a safer, faster, and more efficient approach to these procedures.

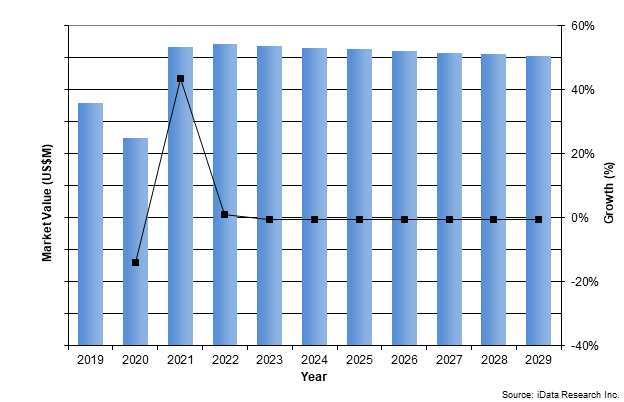

According to our new market research analysis, even though there is an anticipated moderate increase in the sales of mechanical uterine tissue devices, particularly hysteroscopic morcellators, during the projected time frame of 2023–2029 in the United States, the market value is expected to moderately decline due to the downward pressure from average selling prices. Let’s look at this more closely.

Overview Of Hysteroscopic Morcellators

Hysteroscopic morcellators are advanced devices designed for the mechanical removal of uterine tissue, incorporating a comprehensive system that includes a handpiece hysteroscope, a control unit, cutting blades, and a footswitch. These systems are often integrated with hysteroscopes and/or fluid management systems. Their primary purpose is to safely remove uterine growths or tissue while preserving the integrity of the uterus to prevent subsequent issues such as infertility.

The development of these devices aims to overcome the limitations associated with traditional electrosurgery procedures that use resectoscopes, which carry risks of complications due to the use of electrosurgical energy and potential thermal injury. By simultaneously cutting and aspirating tissue, morcellators optimize the removal of specimens and eliminate the need for additional instruments or dredging of the uterine cavity.

A crucial feature found in all hysteroscopic morcellators is the incorporation of automated fluid management systems. These systems continuously monitor the input and output of distending media, intrauterine pressure, and fluid deficit volume. The fluid management system plays a vital role in ensuring a clear view of the uterine cavity throughout the procedure.

The projected forecast suggests a moderate decrease in the market value of hysteroscopic morcellators. This decline can be attributed to two key factors: the decreasing average selling prices (ASPs) and the increasing competition within the market. One notable example is the entry of Meditrina into the market with its Aveta System, a single-use hysteroscopic morcellator launched in July 2021.

Figure 1: Market Value of Hysteroscopic Morcellators. Access iData’s U.S. Market Report Suite for Gynecological Market Devices for more granular detail.

Significance Of Hysteroscopic Morcellators Within The U.S. Gynecological Market

In recent years, the available evidence demonstrated that hysteroscopic morcellators are a safe and effective minimally invasive alternative in treating intrauterine pathologies such as endometrial polyps and uterine myomas and the removal of placental remnants, among other gynecological conditions.

It has been proved that polypectomies performed with intrauterine morcellation were less painful and more acceptable to women when compared with traditional electrosurgery implemented with bipolar resectoscopes for the removal of endometrial lesions.1 This data strongly supports the adoption of hysteroscopic morcellators within office environments for a range of procedures, highlighting their efficacy and suitability thanks to the miniaturized scopes. Miniaturized scopes reduce patient discomfort and pain during the procedure. The smaller diameter of these scopes minimizes tissue trauma, leading to reduced postoperative pain and faster recovery times. The introduction of miniaturized scopes, such as the TruClear 5C hysteroscope (5.25 mm) and TruClear Elite Mini hysteroscope (6.15 mm) by Medtronic, has facilitated use of these devices in office-based settings.

Electrosurgery involves resectoscopes with bipolar and monopolar electrodes. Similarly, to hysteroscopic morcellation, gynecological electrosurgery is indicated to remove the lining of the uterus, abnormal cervical tissues, and other vaginal lesions. While electrosurgery is the conventional procedure to treat uterine cavity diseases, it has some drawbacks. On the one hand, the electrothermal effect during resection can reduce the residual endometrial area and the secretion function of glands, which affects implantation of fertilized eggs. On the other hand, the air bubbles generated during the operation block the operative field of view, which also increases the possibility of complications such as uterine perforation and air embolism to a certain extent.2

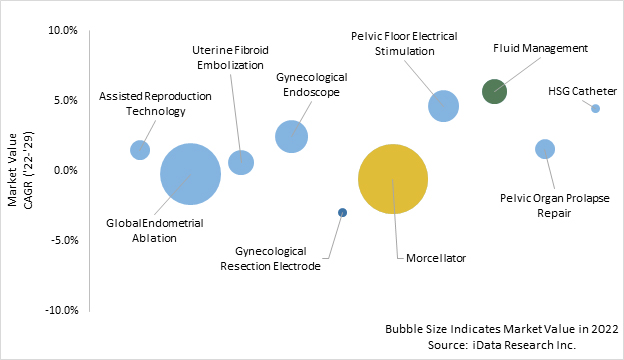

The market value of hysteroscopic morcellators holds significance within the overall gynecological market. Hysteroscopic morcellators contribute approximately one-third of this market value. The introduction of safer and more efficient devices has led to a decline in electrosurgery. Gynecological electrosurgery and resectoscopes rely on outdated technology for tissue ablation and removal. In contrast, hysteroscopic morcellators, functioning as wands, offer a mechanical method with higher success rates while preserving the integrity of the uterus.

Figure 2: Market Value Bubble Chart of Gynecological Market Segments in 2022. Access iData’s U.S. Market Report Suite for Total Gynecological Market Devices for more granular detail.

Hysteroscopic Morcellators Products

Notable products in the hysteroscopic morcellation device market include Medtronic's TruClear hysteroscopic tissue removal system, Hologic's MyoSure tissue removal system, Minerva Surgical's Symphion, and Meditrina's Aveta. These devices showcase advancements in technology and contribute to the expanding market for hysteroscopic morcellators.

Medtronic’s TruClear hysteroscopic tissue removal system has been on the market since 2004. It is purely mechanical, as it does not use any electric currents. This reduces the risk of patient harm through air or gas emboli that may arise in the uterus from administrating electrical energy. The system itself includes a control unit, footswitch, and handpiece. Medtronic inherited the TruClear hysteroscopic tissue removal system in its 2016 acquisition of Smith & Nephew’s gynecological business.

Hologic’s MyoSure tissue removal system has been in the market since 2009. The MyoSure procedure has captured attention in the gynecological market through its procedural time efficiency and low risk profile. The procedure is outlined in three steps. In the first step, a small incision in the cervix is administered by the gynecologist, through which a telescope is inserted into the uterus. Second, once the doctor has a better visualization of the uterus via the telescope, a wand is passed into the uterus via the vagina and slices the fibroid/polyps/abnormal uterine growth into small pieces, which are then suctioned out of the body. In the third step, the wand is removed.

Another device is Minerva Surgical’s Symphion, which has been in the market since 2014. Symphion includes a controller, the Symphion 6.3 mm hysteroscope, the Symphion 3.6-mm resecting device (with radiofrequency bipolar technology), and Symphion fluid management accessories. In 2020, Minerva Surgical inherited the Symphion product after acquiring Boston Scientific’s intrauterine portfolio.

Another popular device is Aveta, launched by Meditrina in July 2021. The device is a disposable hysteroscopic morcellator with a high-speed mechanical oscillation mechanism that received 510(k) premarket notification in May 2020.

Closing Thoughts

Hysteroscopic morcellators are expected to experience a moderate growth in unit volume, gradually replacing conventional resectoscopes in the U.S., as well as an increase in units sold. Their adoption is driven by the advantages they offer, such as enhanced safety, efficiency, and preservation of the uterus' integrity. Overall, the introduction of mechanical hysteroscopic morcellators has transformed the field of gynecological surgery, providing improved treatment options and reshaping the landscape of the gynecological device market.

References

- Franchini, M., et al (2021) Mechanical hysteroscopic tissue removal or hysteroscopic morcellator: understanding the past to predict the future. A narrative review, Facts Views Vis Obgyn, 13 (3): 193-201

- Ren, F, et al (2022) Comparison of Hysteroscopic Morcellation Versus Resectoscopy in Treatment of Patients with Endometrial Lesions: A Meta-Analysis, Medical Science Monitor, doi: 10.12659/MSM.936771

About The Authors:

About The Authors:

Federica Cogoni is a research analyst at iData Research. She develops and composes syndicated research projects about the medical device industry in various fields.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of medical devices used in the health of patients all over the globe.