Will Bioresorbable Vascular Stents Overtake Drug-Eluting Stents As The Gold Standard In CAD Treatment?

By Sean Messenger, Megha Maheshwari, Swarnadip Dutta, and Harsh Parikh, Decision Resources Group

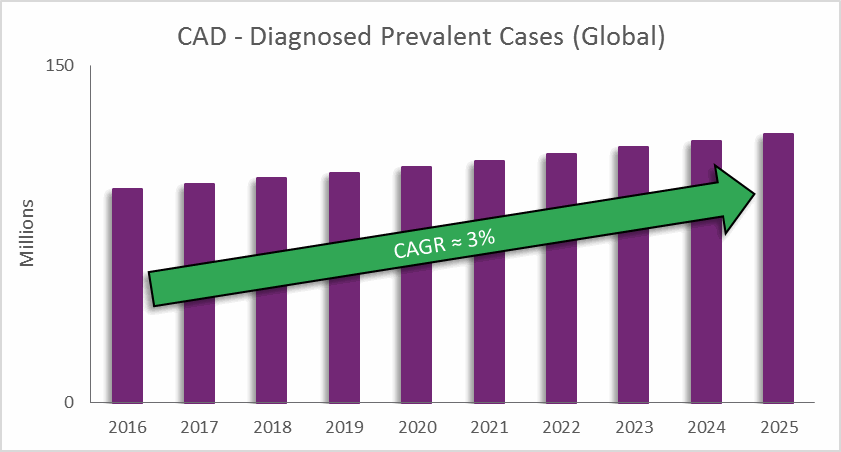

Coronary artery disease (CAD) is one of the leading causes of death across the globe, and it is predicted to remain so for the next 15 years. CAD results from atherosclerotic lesions — caused by cholesterol and other material building up on inner artery walls — which narrow the arteries and block blood supply to the heart. Over time, CAD can lead to other heart problems, such as heart failure and arrhythmias.

CAD Treatment

One of the most potent weapons in a cardiologist’s arsenal for combating CAD is the coronary stent. Approval of the first coronary bare-metal stent (BMS) in 1994 marked a revolution in cardiology by allowing physicians to provide a long-term, minimally invasive solution to patients — beyond the previous standard of plain old balloon angioplasty (POBA).

Coronary stents were not without their drawbacks, though: in-stent restenosis (ISR) was a common complication associated with early BMS devices. Consequently, drug-eluting stents (DES) were introduced to the market in 2001 to combat the ISR problem. Coated with an anti-proliferative drug, these stents successfully reduced the burden of ISR in percutaneous coronary intervention (PCI) patients. Early generations of DES devices showed concerning trends related to late-stent thrombosis (LST), but manufacturers engineered newer generations to limit this problem, and this success has led to DES being recognized as the gold standard in CAD treatment for the past 10 years.

Despite the success of drug-eluting stents, the cardiology community has long recognized the disadvantages of leaving a metal object in the coronary vasculature. Late-stent thrombosis (LST) is a serious complication that has been experienced with DES in the past, and while ISR is reduced, it remains a concern. Additionally, stent fracture can cause adverse outcomes for patients treated with these devices. Finally, future interventions — such as bypass surgery or noninvasive imaging of the treated vessel — often are difficult or impossible to perform on coronary arteries treated with a metallic stent. With these problems in mind, the holy grail of coronary intervention has always been a device that completely disappears (or “resorbs”) over time, leaving the patient’s coronary arteries metal-free.

The ABSORB Trials

The flagship device in the first wave of bioresorbable devices — otherwise known as bioresorbable vascular scaffolds (BVS) — is the Absorb BVS from Abbott Vascular. The device is available in more than 100 countries, gaining CE mark in 2011 and FDA approval in July 2016. The clinical community’s anticipation for this device had been palpable, at times being dubbed a potential “fourth revolution” in interventional cardiology (after the first three “revolutions” of POBA, BMS, and DES). However, results from large randomized trials have tempered that enthusiasm and called into question the future of this device.

The ABSORB II trial was the first randomized controlled trial comparing BVS to DES, and 3-year results from that trial — a time point at which the device should be almost fully resorbed — failed to show the expected benefits of the device, and in fact displayed a worrying trend of increased adverse clinical events compared to DES, including scaffold thrombosis. The larger ABSORB III pivotal trial showed that the Absorb device was statistically noninferior to DES, but concerns about device use in small vessels led to more restrictive labeling upon FDA approval.

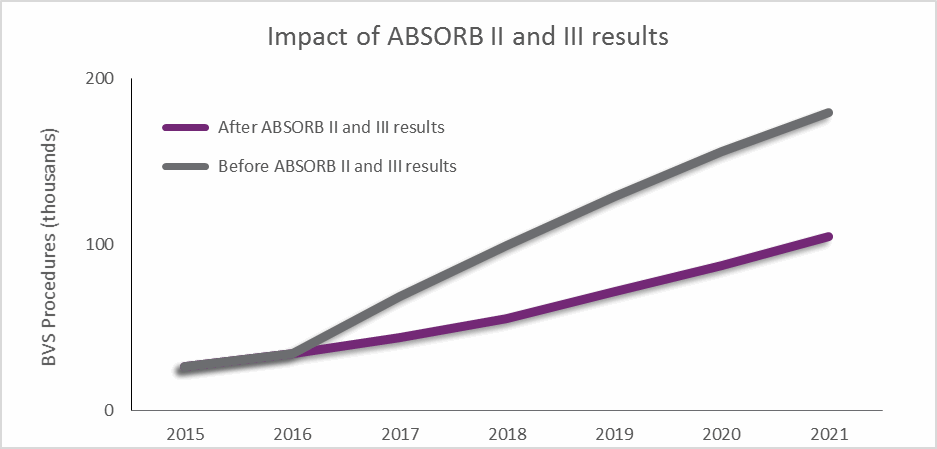

The results from these trials have led to calls for more long-term data on the device, and will limit physician adoption in the short term, as shown by the forecasts displayed in Fig. 2. “I think a lot of the enthusiasm for BVS has waned,” one US cardiologist told DRG. “There has been more and more accumulating data supporting the use of second-generation DES.”

In response, Abbott Vascular initiated action in Europe that has limited the sale of Absorb devices to facilities participating in postmarket registries, and the company continues to recruit for its 5000-patient ABSORB IV postmarket study in the US, Europe, Canada, and Australia.

The Global Picture

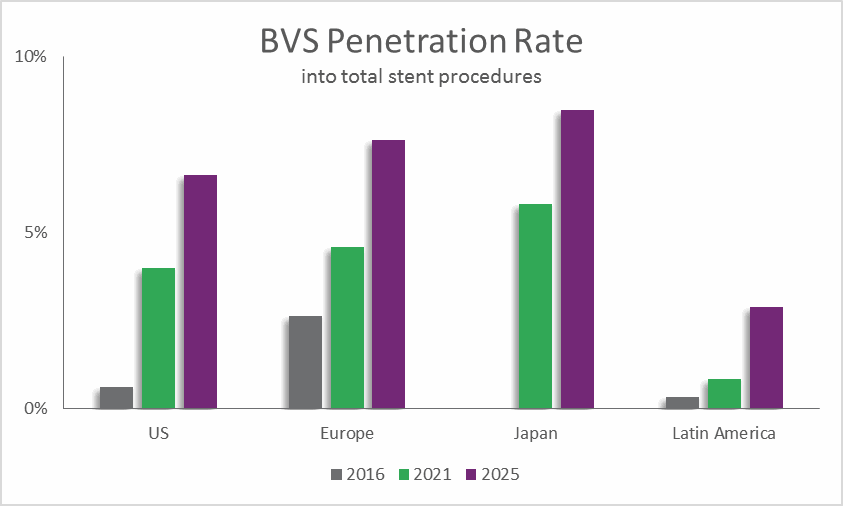

In 2016, BVS treatment accounted for about 3 percent of stented procedures in Europe, and less than 1 percent of stented procedures in the US. Before results of the ABSORB II and ABSORB III trials were known, those penetration rates were expected to increase significantly. However, the increase in BVS penetration has been pushed out due to the need for stronger clinical data.

In the US, Absorb sales peaked in October 2016 and then declined in November 2016, the first month since approval in which sales did not increase. November 2016 also happened to be the month following the release of negative ABSORB II data. This trend is expected to be reflected in other regions globally in 2017. In Europe, facilities that are under cost pressures may decide to use less costly and better-reimbursed DES devices. Even in India, the largest single market for Absorb in 2016, overall use of BVS will be tempered in 2017 due to the negative clinical trial results. Moreover, the price cap applied to coronary stents in April 2017 by India’s National Pharmaceutical Pricing Authority (NPPA) will discourage companies from selling these premium-priced products in this unfavorable market. This action will add to the downward pressure on the BVS market in the country.

Not All Doom And Gloom For BVS

Despite the difficulties experienced by the Absorb device, bioresorbable devices still represent the future for coronary stents. Abbott Vascular’s decision to limit Absorb sales to facilities in Europe will contribute to long-term study of the device, which could actually benefit the company and the prospects of the market, given that this will limit the use of the device to experienced physicians, who then will be able to improve upon best practices.

Additionally, the device recently received MHLW reimbursement approval in Japan, and it is expected to fully commercially launch in 2018 following encouraging results from the ABSORB Japan trial, which showed no difference in safety and effectiveness for Absorb compared to gold-standard DES treatment. Future generations of the Absorb device are expected to include engineering enhancements that will lower complications associated with the device.

Finally, in addition to Absorb, there are several other promising BVS devices currently under development. BIOTRONIK’s Magmaris device showed positive 2-year results in the BIOSOLVE-II trial and consistent safety indicators in 6-month combined analysis of the BIOSOLVE-II and BIOSOLVE-III studies. BIOTRONIK's Magmaris system received CE marking in June 2016 and is expected to gain market share in the BVS space, because it is a unique polymer-free BVS system that is absorbed into the body within 1 year after implantation, versus the 3 years associated with Absorb. Furthermore, clinical presentations at EuroPCR in May 2017 and TCT in October 2016 showcased promising initial results for several BVS devices, including the Aptitude device from Amaranth Medical, the DESolve Cx and Nx from Elixir Medical, Reva Medical’s Fantom BVS, the MesRes100 from Indian manufacturer Meril Lifesciences, and the Firesorb BRS from China’s MicroPort. A common thread among these devices was thin struts, absorption within a year, and no early signs of scaffold thrombosis.

All of the studies presented are relatively small, but each one pushes the BVS field forward, and a composite of positive results will help convince physicians that this is a technology worth investigating and using. More robust clinical results, as well as the development of a new generation of BVS devices, could allow the technology to follow the same path that DES once did – becoming the gold standard treatment after some initial questions about clinical complications were solved by engineering and ingenuity.

About The Authors

Sean Messenger is a manager on the Cardiovascular Medtech Insights team. In this role, he leads a team of analysts responsible for monitoring and analyzing global cardiovascular device markets through the production of DRG’s Medtech 360 product. Sean has led and participated in several speaking engagements, including leading a conference talk at the Life Sciences Forum in Costa Rica entitled “The Next Five Years in the Cardiovascular Device Market”, and has partnered with Bloomberg Intelligence during ACC 2016 and TCT 2016 to lead talks on emerging cardiovascular therapies.

Sean Messenger is a manager on the Cardiovascular Medtech Insights team. In this role, he leads a team of analysts responsible for monitoring and analyzing global cardiovascular device markets through the production of DRG’s Medtech 360 product. Sean has led and participated in several speaking engagements, including leading a conference talk at the Life Sciences Forum in Costa Rica entitled “The Next Five Years in the Cardiovascular Device Market”, and has partnered with Bloomberg Intelligence during ACC 2016 and TCT 2016 to lead talks on emerging cardiovascular therapies.

Megha Maheshwari is a Lead Analyst on the Cardiovascular Medtech Insights team. From her long experience with hospitals and healthcare research firms including GlobalData and IMS Health, she brings extensive knowledge of several Medtech & Pharma markets to the team. She is specialized in interventional cardiology, peripheral vascular and coronary artery bypass graft devices markets, and has authored several DRG Medtech blogs. Megha holds a Bachelors in Physiotherapy degree from Hemwati Nandan Bahuguna Garhwal University, and a MBA in Healthcare IT from NIMS University. She also has a postgraduate Diploma in Hospital Administration, Certification in Nutrition and Child Care, and International Medical Tourism.

Megha Maheshwari is a Lead Analyst on the Cardiovascular Medtech Insights team. From her long experience with hospitals and healthcare research firms including GlobalData and IMS Health, she brings extensive knowledge of several Medtech & Pharma markets to the team. She is specialized in interventional cardiology, peripheral vascular and coronary artery bypass graft devices markets, and has authored several DRG Medtech blogs. Megha holds a Bachelors in Physiotherapy degree from Hemwati Nandan Bahuguna Garhwal University, and a MBA in Healthcare IT from NIMS University. She also has a postgraduate Diploma in Hospital Administration, Certification in Nutrition and Child Care, and International Medical Tourism.

Swarnadip Dutta is a Senior Analyst on the Cardiovascular Medtech Insights team at Decision Resources Group, specializing in heart rhythm, interventional cardiology, vascular access and vascular closure markets. Swarnadip holds a Master's degree in Bioinformatics and Biotechnology from SRM University, India. He also holds a Master's degree in Business Administration (MBA) in Operations Management and has a six sigma green belt certification from Indian Statistical Institute (ISI), Hyderabad, India. He has diverse experience in competitive intelligence, company profiling, market access research and stategic pricing analysis. He is also involved in creating a position paper on demand side challenges for adoption of medical devices in India in collaboration with AdvaMed. Follow Swarnadip on Twitter at @Swarnadip_DRG.

Swarnadip Dutta is a Senior Analyst on the Cardiovascular Medtech Insights team at Decision Resources Group, specializing in heart rhythm, interventional cardiology, vascular access and vascular closure markets. Swarnadip holds a Master's degree in Bioinformatics and Biotechnology from SRM University, India. He also holds a Master's degree in Business Administration (MBA) in Operations Management and has a six sigma green belt certification from Indian Statistical Institute (ISI), Hyderabad, India. He has diverse experience in competitive intelligence, company profiling, market access research and stategic pricing analysis. He is also involved in creating a position paper on demand side challenges for adoption of medical devices in India in collaboration with AdvaMed. Follow Swarnadip on Twitter at @Swarnadip_DRG.

Harsh Parikh is an Analyst on the Cardiovascular Medtech Insights team at Decision Resources Group, specializing in Interventional oncology, interventional cardiology and Diabetes markets. Harsh holds a Master's degree in Pharmceutical Sciences and Biotechnology from National Institute of Pharmaceutical Education and Research, India. He has diverse experience in Strategic sourcing and supply chain management, competitive intelligence, company profiling, market access and consulting with major Pharma and MedTech companies. He is also involved in creating a position paper on demand side challenges for adoption of medical devices in India in collaboration with AdvaMed. Follow Harsh on Twitter at @HDParikh_DRG.

Harsh Parikh is an Analyst on the Cardiovascular Medtech Insights team at Decision Resources Group, specializing in Interventional oncology, interventional cardiology and Diabetes markets. Harsh holds a Master's degree in Pharmceutical Sciences and Biotechnology from National Institute of Pharmaceutical Education and Research, India. He has diverse experience in Strategic sourcing and supply chain management, competitive intelligence, company profiling, market access and consulting with major Pharma and MedTech companies. He is also involved in creating a position paper on demand side challenges for adoption of medical devices in India in collaboration with AdvaMed. Follow Harsh on Twitter at @HDParikh_DRG.