How Has COVID-19 Affected Europe's Vascular Access Devices Market?

By Kamran Zamanian, Ph.D., iData Research Inc.

COVID-19 has impacted the demand for medical devices in many different ways. While the devices used to treat COVID-19 patients in intensive care have seen a spike in demand, other devices have been negatively affected due to postponed or cancelled procedures. In Europe, specifically, this scenario has been observed across multiple medical device segments. Detailed analysis of the impact of COVID-19 on single-use medical devices for vascular access has provided some interesting market insights. Most notably, this includes a spike in demand for central venous catheters (CVCs) as well as syringes and needles.

Increased Demand For Central Venous Catheters

Acute central venous catheters are used for gaining immediate high-flow vascular access. CVCs are inserted through the internal jugular, subclavian, and femoral veins. COVID-19 patients who are hospitalized typically require placement of an acute CVC for immediate vascular access. CVCs have long been the standard device for gaining vascular access in emergencies, where patients require large volumes of fluids in short periods of time.

Although necessary for treatment, CVCs also represent a risk for patients. The main disadvantage of CVCs is that the patient becomes susceptible to infection. Catheters provide a direct route to the bloodstream for bacteria colonized around the insertion site and along the surface of the catheter. Catheter-related bloodstream infections (CRBSIs) vary depending on the vein used for CVC placement. Femoral placement is associated with the highest risk of CRBSIs, while subclavian placement has the lowest incidence of infection. In 2009, the Joint Commission guidelines recommended that catheters should only be placed in the femoral vein if no other sites are available. Approaches used for combating CRBSIs include improving sterility in the implantation setting, increasing healthcare worker training and education, and creating catheters that are less susceptible to infection. According to a study by Buetti et al., COVID-19 patients have an increased risk of contracting ICU-acquired bloodstream infections. As a result, sales of antimicrobial acute CVCs have represented the majority of the total acute CVC market. Antimicrobial acute CVCs sell at a premium compared to conventional CVCs. The increasing penetration rate of antimicrobial CVCs will cause the total CVC market to appreciate over the next seven years.

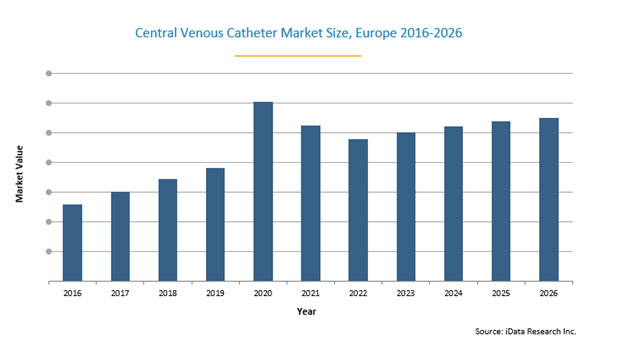

The increase in usage of acute CVCs for COVID-19 patients has driven a temporary surge in demand. The total market value for CVCs in Europe for example, increased approximately 6% from 2019 to 2020, but is expected to stabilize over the next few years as more people are fully vaccinated.

Ups And Downs In Demand For Associated Syringes And Needles

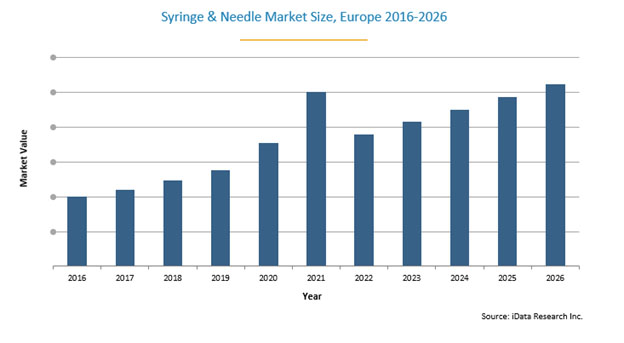

The COVID-19 vaccination is expected to have a positive impact on total unit sales of syringes and needles in 2021, and possibly beyond. Widespread distribution of the vaccine is expected to continue after the first half of 2021, and the majority of the European population is expected to have the option of receiving the vaccine by the end of the year.

With both an increased number of hospitalizations and growing COVID-19 vaccinations, the European market is expected to see market ups and downs. Growth has been recorded from 2020 to the end of 2021, but the market is expected to adjust, not necessarily returning to pre-COVID levels. iData estimated that the total European syringe and needle market grew approximately 5% in 2020 and expects it to grow by a further 5% in 2021. Then, the total value is expected to decline almost 6% in 2022 before stabilizing at pre-pandemic low single-digit rates. This positive forecast is driven by many factors, most notably, the extended use of safety products and new technologies, both with higher price tags.

Negative Effects Of COVID-19 On Other Vascular Access Devices And Accessories

Many elective procedures and surgeries are being cancelled or postponed as healthcare personnel and hospitals focus on treating those affected by the pandemic. As a result, the markets for vascular access devices and accessories not directly used in COVID-19 treatments declined in value in 2020.

Subcutaneous implantable ports and port needles are good examples of markets that experienced the negative effect of the pandemic. These devices are used by patients that require long-term treatment and constant vascular access. Implantable ports are reservoirs that are implanted into the body and connected to the superior vena cava by a catheter. These devices require invasive surgical implantation by vascular surgeons or interventional radiologists. With many procedures cancelled or postponed, demand for implantable ports and port needles has declined.

Dialysis catheters have also seen declines due to the pandemic, primarily in the long-term hemodialysis segment, because patients need to visit the hospital to get the catheter implanted. These devices are used for facilitating dialysis for patients whose kidneys are unable to properly filter water and waste. Most patients treated with dialysis have been diagnosed with end-stage renal disease; however, patients suffering from acute kidney failure can also receive dialysis.

What’s Next For Vascular Access Devices And Accessories In Europe?

Overall, the negative impact on the European vascular access device market is expected to be minimal. Commodity markets, such as CVCs and syringes and needles, are expected to maintain their market values. Despite an overall decrease in the number of hospitalization days recorded in 2020 compared to the previous year, these low-cost disposables are expected to continue to be sold in high volumes.

Source: iData Research. 2021 Europe Market Report Suite for Vascular Access Devices | MedSuite | COVID-19 Update (https://idataresearch.com/product/vascular-access-devices-market-europe/)

About the Author:

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of dental and medical devices used in the health of patients all over the globe.

Kamran Zamanian, Ph.D., is CEO and founding partner of iData Research. He has spent over 20 years working in the market research industry with a dedication to the study of dental and medical devices used in the health of patients all over the globe.

About iData Research

For 16 years, iData Research has been a strong advocate for data-driven decision-making within the global medical device, dental, and pharmaceutical industries. By providing custom research and consulting solutions, iData empowers its clients to trust the source of data and make important strategic decisions with confidence.